Hold PVR INOX Ltd for the Target Rs. 1,211 By Prabhudas Liladhar Capital Ltd

Second best quarter post COVID

Quick Pointers:

* Net debt, post-merger, has reduced by more than half to Rs6,188mn.

* Footfalls increase 14.7% YoY to 44.5mn with an occupancy of 28.7%.

PVRINOX IN reported better than expected performance with pre-IND AS EBITDA margin of 16.8% (PLe 15.4%) aided by 14.7% YoY rise in footfalls to 44.5mn (PLe 44.0mn) amid strong BO performance across languages. Despite a solid performance (2nd best quarter post-COVID) in 2QFY26, we broadly maintain our estimates for the year as our existing 2HFY26E ask-rate for footfalls and pre-IND AS EBITDA stands at 69mn/Rs4,150mn respectively. To bring footfall stability and attract value conscious audience, PVRINOX IN has plans to roll out smart screens in tier-2 & 3 markets. In our view, smart screens could turn out to be a structural lever to bridge the gap between high ATP and stagnant admissions. On the other hand, a dine-in cinema has been launched in Bangalore. The bet here is on food becoming a core draw, not just an add-on. The objective is 2 pronged 1) elevate the cinema into a lifestyle venue and 2) strengthen non-ticket revenues. We would await proof of concept on these moves and expect footfall CAGR of 6.7% over the next 2 years with pre-IND AS EBITDA margin of 12.4%/15.6% in FY26E/FY27E. Retain HOLD on the stock with a TP of Rs1,211 (10.5x FY27E EBITDA; no change in target multiple).

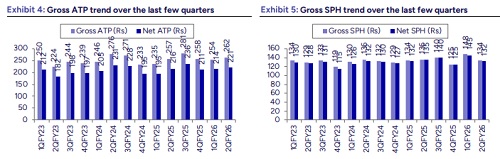

Top-line increased 12.4% YoY: Top line increased 12.4% YoY to Rs18,230mn (PLe Rs18,272mn). Movies like Saiyaara, Coolie, Mahavatar Narsimha, War 2, They Call Him OG, Lokah: Chapter 1, Jurassic World: Rebirth, Jolly LLB 3, Su from So, Mirai, Hari Hara Hera Mallu, and The Conjuring: Last Rites have aided topline. Footfalls increased 14.7% YoY to 44.5mn (PLe 44.0mn) while occupancy stood at 28.7% in 2QFY26. Gross ATP increased 1.9% YoY to Rs262 (PLe of Rs262) while gross F&B SPH declined marginally by 1.5% YoY to Rs134 (PLe of Rs135).

Pre-Ind AS EBITDA margin at 16.8%: Ind-AS adjusted EBITDA increased 64.2% YoY to Rs3,068mn (PLe of Rs2,821mn) with a margin of 16.8% as compared to a margin of 11.5% in 2QFY25. Ind-AS adjusted PAT stood at Rs1,265mn (PLe of Rs1,142mn) with a margin of 6.9% in comparison to an Ind-AS adjusted PAT of Rs224mn in 2QFY25 with a margin of 1.4%.

Con-call highlights: 1) Dine-in cinema concept has been launched in Bangalore, offering gourmet dining alongside movie screenings on LED screen. 2) In 2QFY26, advertising revenue was led by FMCG, banking, textiles, e-commerce, and jewelry sectors. 3) As of 2QFY26, cash balance stood at Rs6,792mn. PVRINOX IN usually maintains fixed cost liquidity cover for 45-60 days and expects the cash balance to normalize over next 6 months as new screens open. 4) The distribution slate for PVR INOX pictures includes movies like Thama, De De Pyaar De 2, Now You See Me (sequel), Christmas Karma, Gustaakh Ishq, and an upcoming film featuring Junaid Khan. Typically, PVR INOX pictures releases ~8–9 Hindi movies and ~15–20 Hollywood movies annually. 5) In 2QFY26 distribution income was down due to high base (Stree-2 was released in 2QFY25 which performed well). 6) Going forward, the screen portfolio will be evenly divided between capital-light and owned cinemas. Within the capital-light model, asset-light formats will have a higher share than FOCO. 7) The Karnataka government’s proposal to cap movie ticket prices at Rs200 has been stayed by the High Court. 8) VPF is currently charged to all films except Hollywood, where the fee has already been phased out globally. The CCI probe on PVRINOX IN for charging VPF fee is only at an investigation stage currently and final verdict is awaited. 9) The Smart Screens initiative aims to tap tier-2 and tier-3 markets, with a POC set to launch this year. 10) SPH declined 9.5% QoQ to Rs134 in 2QFY26 due to 3 factors: (1) Dominant release like Mahavatar Narsimha attracted viewers (Jain/religious community) who largely refrained from consuming F&B (especially from outlets serving nonveg); (2) 4 A-rated films (The Conjuring: Last Rites, Baaghi-4, The Bengal Files, & Demon Slayer) drew a more restrained audience; and (3) higher turn-out from Tuesday Saver Days plan (15–17% of footfalls) that witnessed lower F&B consumption.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271