Hold Apar Industries Ltd for the Target Rs. 9,540 By Prabhudas Liladhar Capital Ltd

Strong domestic outlook; watchful on tariffs

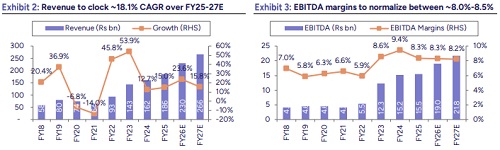

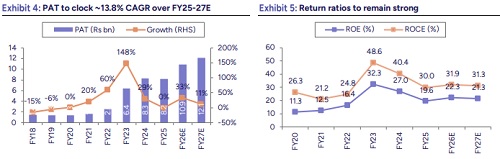

We interacted with the management of Apar Industries (APR) to discuss the implications of the US reciprocal tariffs, the prevailing demand environment, and prospects. Management indicated that the tariffs are unlikely to materially impact the conductors business, though they may have a marginal effect on the cables segment (~20% exposure to the US). In conductors, India’s growing reconductoring opportunity is expected to be a key growth driver. The cables business is positioned for strong momentum, with management targeting to reach ~Rs100bn in revenue over the next three years, supported by rising demand for specialty, power, and low-duty cables driven by the energy transition. Meanwhile, APR’s transformer oils segment is expected to maintain >10% revenue CAGR with healthy margins, underpinned by robust global demand and the company’s dominant share in India’s HVDC transformer oil market. The stock is trading at a P/E of 32.7x/29.4x on FY26/27E earnings. We maintain our ‘Hold’ rating valuing the Conductors/Cables/Specialty Oils segment at a PE of 35x/35x/12x Mar’27E (same as earlier) arriving at a SoTPderived TP of Rs9,540 (same as earlier).

We believe, Chinese competition in non-US markets, pace of re-tendering in Indian market and potential tariff impact on cables segment to be key monitorable in medium term. However, we are long-term positive on the stock owing to 1) robust T&D capex driving demand across segments, 2) focus on premium conductors in the domestic market, 3) healthy traction in elastomeric cables used in renewables, defence and railways, and 4) market leadership in the growing T-oils business.

Management meet key takeaways:

USA reciprocal tariff implications:

In FY25, the USA contributed ~8–9% of Apar’s consolidated revenue, compared with ~11–12% in FY24 and ~16% in FY23. Apar exports conductors, cables, and specialty oils to the US market, with the revenue mix in FY25 comprising ~6% of conductors, ~5% of specialty oils, and ~20% of cables.

Implications for Conductors’ business:

* In the conductors’ business, management highlighted that reciprocal tariffs create a level playing field in the US, as all aluminium imports attract the same duties regardless of the country of origin.

* Since aluminium accounts for over 80% of a conductor’s content, the tariffs are not expected to have a material impact on Apar’s conductors’ business.

* In cables, the composition is roughly 50% aluminium and 50% non-aluminium. The reciprocal tariffs therefore apply only to the non-aluminium portion

* Despite the current 50% reciprocal tariffs, US customers continue to source from Apar, as they can absorb the impact and pass it on to end users— primarily utility companies.

* Demand from the US remains strong given the absence of significant domestic manufacturing capacity in the USA, which will take considerable time to develop

Conductors: Domestic reconductoring to drive decadal opportunity

* Reconductoring demand in India remains strong, as upgrading with premium conductors such as HTLS offers significant advantages over building new transmission lines, including lower capital costs, resolution of right-of-way challenges, and faster execution.

* Apar has executed over 160 reconductoring projects in India and expects the momentum to sustain, driving a higher share of premium products in the coming years.

* Key domestic customers include state utilities such as Gujarat Energy Transmission Corporation (GETCO) and Northeast Transmission Company (NETC).

* Recent margin improvement in the conductors segment was supported by strong demand for premium conductors in India and higher export margins from the US market.

Cables: Apar targets to reach ~Rs100bn revenue in next three years

* Management continues to guide for ~25% revenue growth in FY26 supported by volume growth and channel expansion.

* Energy transition to renewable energy is driving robust demand for specialty cables such as cables for solar, wind, defence, mining etc. which also has better margins.

* The Low Duty Cables (LDC) revenue stood at ~Rs3.8bn in FY25 and is expected to clock a revenue CAGR of 35%-40% in next few years.

* Low voltage power cables have lower margins in India while high voltage cables have average margins. The competition in solar cables is high which has led to lower margins

Transformer Oils (T-oils): Apar is 3rd largest T-oils player globally

* Transformer oil accounts for ~5% of the total transformer cost and its primary customers include leading transformer manufacturers such as Hitachi energy, Siemens energy, Bharat Bijlee, Voltamp Transformers etc.

* Apar’s transformer oil business is anticipated to clock more than 10% CAGR over the next few years with better than average margins.

* Apar has more than 80-90% market share in T-oils for HVDC transformers in India.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271