Reduce Greenpanel Industries Ltd For Target Rs. 270 By JM Financial Services

In-line margin; focus on market share gains

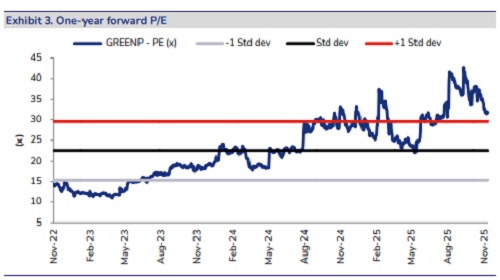

Greenpanel Industries (Greenpanel) reported strong operating performance in 2QFY26 with consolidated revenue increasing ~18% YoY/ 21% QoQ to ~NR 4bn in 2Q. Reported EBITDA declined ~17% YoY to INR 248mn (JMFe: INR 199mn); while adjusted EBITDA (excluding forex loss) rose 25% YoY/ ~3.8x QoQ to INR 367mn. MDF volume rose 25% YoY/ 24% QoQ to ~127k cbm, while MDF realisation declined ~4% YoY/ 2% QoQ to INR 27,927/cbm. The management guided volume growth of high teens for domestic MDF with EBITDA margin (including EPCG scheme) of high single-digit to low double-digit for FY26. Going forward, it aims on volume growth along with better margins. Factoring in 2Q performance along with continued near-term weakness, we cut our EPS estimates by ~15% for FY27E-28E. In line with our new rating system, we change our rating from HOLD to REDUCE with a revised TP of INR 270/sh based on 23x Dec’27 P/E post quarterly roll-over.

* Result summary: Greenpanel reported revenue growth ~18% YoY/ 21% QoQ to ~NR 4bn in 2Q. Reported EBITDA declined ~17% YoY/ negative INR 158mn QoQ to INR 248mn (JMFe: INR 199mn). while adjusted EBITDA (excluding forex loss) rose 25% YoY/ ~3.8x QoQ to INR 367mn. Adjusted EBITDA margin grew 54 bps YoY/ 631 bps QoQ to 9.3% in 2Q. Reported net loss came at INR 61mn vs. PAT INR 185mn YoY/ net loss INR 346mn QoQ. MDF volume rose 25% YoY/ 24% QoQ to ~127k cbm, while MDF realisation declined ~4% YoY/ 2% QoQ to INR 27,927/cbm. Plywood volume declined 5% YoY/ grew ~19% QoQ to 1.4msm, and plywood realisation decreased ~1% YoY/ 7% QoQ to INR248/msm. Net debt increased INR 770mn YoY/ declined INR 600mn QoQ to INR 1.73bn as of Sep’25; however, excluding the forex movement, net debt declined ~INR 710mn QoQ. In 1H, the company has generated FCF of INR 338mn post working capital release of INR 314mn and capex spend of INR 225mn.

* What we liked: Improvement in working capital days and decline in net debt

* What we did not like: Weak performance in plywood segment

* Earnings call KTAs: 1) The management guided volume growth of high teens for domestic MDF with EBITDA margin (including EPCG scheme) of high single-digit to low double-digit for FY26. Going forward, it continues to focus on volume growth and improved margins. 2) In FY25, MDF demand (17mm thickness) stood at 2.75-2.8cbm while capacity stood at 4.2cbm. It expects no major capacity additions in FY26 and FY27. However, there could be some minor additions in the unorganised sector. 3) Company witnessed slowdown in MDF imports at 3,000cbm in 2Q. Capacity utilisation stood at ~53%; aims to its divide production in the most optimum manner. 4) It expects no major MDF price hike in the near term; focus remains to increase market share and improve margins. 5) In 2Q, timber cost remained stable; expects to remain broadly stable or may slightly decline. 6) For FY26, company expects capex of INR 350-400mn including some last year spill over from MDF capex. Going forward, it expects a steady capex of INR 200-300mn in the near term. 7) On the BIS implementation front, company highlighted draft is already in place; awaiting for the official announcement. 8) It realised EPCG grant of INR 60mn vs. INR 51mn QoQ; balance of INR 400mn yet to be accounted.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361