Buy Greenply Industries Ltd For Target Rs. 460 By Yes Securities Ltd

Overall performance was better than expected; retain BUY and maintain Greenply as top pick!

Result Synopsis

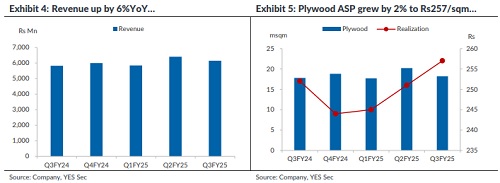

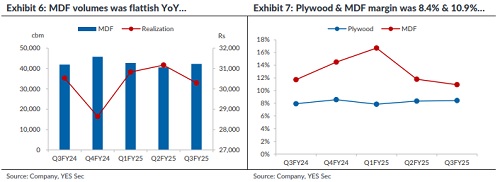

Greenply Industries Ltd reported a soft quarter which was better than our expectations as MDF segment reported better numbers despite plant shutdown while Plywood volumes were flattish. In ply, volumes grew by 2%YoY Vs our estimate of 6% as management focused more on controlling debtors which lead to a loss of ~1.5-2% on sales. Ply margins were largely maintained at 8.4% Vs 7.9%/8.3% in Q3FY24/Q2FY25 respectively owing to price hikes taken during quarter which resulted into better realizations at Rs257/sqm Vs Rs252/Rs251 in Q3FY24/Q2FY25 respectively. For MDFs, company had ~10-days plant shutdown due to a machine part failure however, despite the same volumes were flattish YoY & EBITDA margins were maintained at 10.9% (Rs3,313/cbm) Vs 11.7% (Rs3,578/cbm) and 11.8% (Rs3,674/cbm) in Q3FY24 and Q2FY25 respectively. In Q3FY25, Greenply took ~1.5% price hike for MDFs. Elevated timber prices kept margins across both segments under check during the quarter. In Q3FY25, company commenced sales from Samet-JV however, in Q4FY25E company will launch to wider distributors and management expects encouraging numbers from this venture.

Stock performance

Management Guidance

Management is confident that demand and margins will rebound in Q4FY25E, for plywood company expects to end FY25E with 7%YoY volume growth and ~50%YoY growth in MDFs, while margins for plywood & MDF should improve to 10% & 16% respectively by Q4FY25E. Notably, management expects timber prices to ease from FY27E and new plywood capacity will also get operational by FY27E start which will boost overall performance.

Our View

We remain positive on Greenply Industries Ltd and retain the company as our TOPPICK from the sector. We maintain our plywood volumes growth of 8%CAGR over FY24-FY27E with new capacity getting operational from start of FY27E, with operating margins of ~9% by FY27E. For MDFs, we expect volume growth of 30%/20% for FY26E/FY27E respectively and an improvement of 2% in ASP. For this segment, we expect gradual expansion in margins by 200bps in both FY26E & FY27E. Moreover, balance sheet should improve from FY26E onwards which should further boost PAT growth. Given the healthy growth expectations and improvement in balance sheet, we believe GREENPLY is available at lucrative P/E(x) of 16x on FY27E EPS of Rs18.4. Hence, we retain our BUY rating on the stock with a target price of Rs460. Reiterate GREENPLY as our top-pick.

Res ult Highlights

* Revenue for the6.14Bn (5% above est), a growth of 6%YoY.

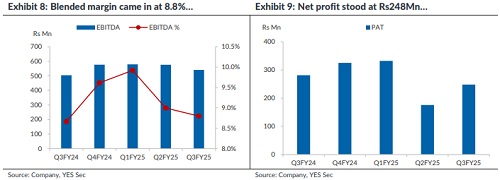

* EBITDA margins came in at 8.8% Vs 8.7%/9% in Q3FY24/Q2FY25 respectively. Absolute EBITDA grew by 7%YoY to Rs541Mn.

* Net profit grew by 18%YoY (excluding the exceptional gain in Q3FY24) to Rs241Mn. PAT growth accelerated due to lower finance cost which came in at Rs51Mn Vs Rs147Mn/Rs145Mn in Q3FY24/Q2FY25 respectively.

Segmental Highlights for Q3FY25

Plywood:

* Volumes improved marginally by 2%YoY to 18.2msqm.

* ASP stood at Rs257 Vs Rs252/Rs251 in Q3FY24/Q2FY25 respectively.

* Revenue increased by 5.5%YoY to Rs4.79Bn.

* EBITDA margins came in at 8.4% Vs 7.9%/8.3% in Q3FY24/Q2FY25 respectively.

MDF (plant shutdown for ~9-10days):

Volumes remained flattish on YoY basis at 42,259cbm.

* ASP also remained flat at Rs30,289 on YoY basis but contracted by 3%QoQ.

* Revenue was flattish both YoY & QoQ at Rs1.28Bn.

* EBITDA margins stood at 10.9% Vs 11.7%/11.8% in Q3FY24/Q2FY25 respectively.

QUARTERLY TRENDS

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632