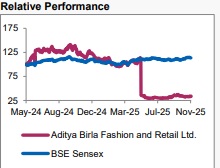

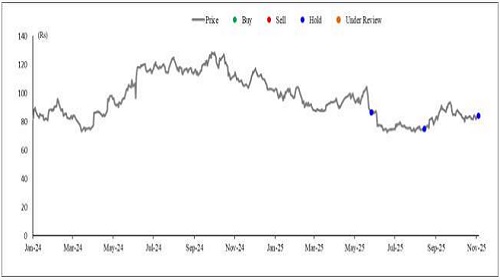

Hold Aditya Birla Fashion & Retail Ltd For the Target Rs.90 by Axis Securities Ltd

Resilient Growth, Margin Miss; Maintain HOLD

Est. Vs. Actual for Q2FY26: Revenue – BEAT; EBITDA – MISS; PAT – MISS

Changes in Estimates post Q2FY26

FY26E/FY27E: Revenue: 1%/2%; EBITDA: 2%/5%;

Recommendation Rationale

* Resilient growth: ABFRL reported a 13% YoY revenue growth in Q2FY26, aided by a strong festive start. Segment-wise, TMRW and Luxury businesses grew 27% and 13% YoY, respectively, while Ethnic and Pantaloons rose 11% and 6% YoY. Gross margins expanded 395 bps YoY to 57.9%, reflecting improved product mix and operational efficiencies. However, EBITDA declined 12.4% YoY with a 99bps margin contraction, owing to higher marketing investments. Despite a cautious consumption backdrop, early festive demand, particularly Pujo, boosted footfalls and sales across retail formats, partially offset by temporary disruptions from heavy rains in Kolkata and regional closures in the Northeast

* Demand Outlook: ABFRL sustained healthy growth across core and emerging segments, driven by strategic investments and brand modernization. With focus on scale, efficiency, and a supportive demand backdrop, the company remains well positioned for steady, profitable growth ahead.

Sector Outlook: Cautious

Company Outlook & Guidance: While the long-term outlook remains strong, we reiterate our HOLD rating considering the overall demand scenario. Current Valuation: 13xSep’27 EV/EBITDA (Earlier Valua

Current TP: Rs 90/share (Earlier: Rs 75/share)

Recommendation: With a 7% upside from the CMP, we maintain our HOLD rating.

Financial Performance:

The company’s consolidated revenue stood at Rs 1,982 Cr, up ~13% YoY, driven by growth across segments. EBITDA came in at Rs 69 Cr, with EBITDA margins at 3.5%, declined by 99 bps YoY, mainly due to higher marketing spends across the portfolio. It reported a negative PAT of Rs 295 Cr.

Outlook

The management’s renewed focus on profitability marks a positive shift. Its strategy of expanding the product lineup through new launches and acquisitions, strengthening brand positioning, and driving digital transformation to increase online sales, including next-generation, digital-first brands under the technology-driven ‘House of D2C Brands’ venture, TMRW, should support long-term growth. However, these initiatives will take time to yield full results. Meanwhile, post-demerger, near-term execution will be key to unlocking value. Hence, we adopt a “Wait and Watch” approach and maintain our HOLD rating on the stock with a revised TP of Rs 90/share, implying a 7% upside from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633