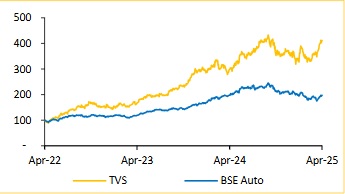

Buy TVS Ltd. For Target Rs.2,920 - Choice Broking Ltd

TVSL Motor Outperforms Estimates Across the Board

* Q4FY25 standalone revenues stood at INR 95,504Mn, ahead of consensus est. of INR 92,831Mn, registering a growth of 16.9% YoY and 5.0% QoQ. Total volumes during the quarter were 12,16,286 units, up 14.5% YoY and 0.4% QoQ. ASP improved by 2.1% YoY to INR 78,521 driven by favourable product mix.

*EBITDA saw a robust growth of 43.9% YoY and 23.2% QoQ to INR 13,326Mn (vs consensus est. at INR 11,693Mn). Margin improvement was driven by lower raw material costs and PLI incentive.

* PAT for Q4FY25 reported at INR 8,521Mn, (vs consensus est. INR 7,312Mn), up 75.5% YoY and 37.8% QoQ. EPS for Q4FY25 is INR17.9.

Company Outlook & Guidance:

The company expects to grow faster than the industry, driven by premium 2W models (Raider, Apache, Ronin, and Jupiter125/110), E-3W (TVS King), and new product launches in both the EV and ICE portfolios over the next two years. We expect total sales volume to grow at 10.8% CAGR over FY25E-27E.

Powering Ahead in the ICE Segment with Strong Growth:

TVSL outperformed the domestic ICE 2W market in Q4, posting 9% sales growth versus the industry’s 7%, while international 2W volumes jumped 23%. The company achieved an alltime high 19.0% share of the domestic 2W market. Segment-wise, motorcycle share dipped slightly to 9.8% (from 10.4% YoY), but scooter share climbed to 29.3%, buoyed by its premium ICE and EV portfolio. To sustain this momentum, TVSL plans more than INR 10Bn of capex through FY26, focused on product development, new technologies and the revival of the Norton brand, with the first Norton models expected by end of FY26

Electrifying the Future with Strong EV Momentum, TVS EV Volumes Jump 44% in FY25, 54% in Q4:

The EV segment remains a key growth driver for TVSL, with a remarkable 44% increase to 2.8Lakh units in FY25 compared to 1.0Lakh in FY24. In Q4FY EV 2W sales increased by 54% reaching 76,000 units from 49,000 units in Q4, with 76,000 units sold, compared to 48,000 units in the same quarter of the previous year. The popular iQube brand and the launch of the TVS King EV Max are driving this expansion. TVSL is also increasing its dealership network, now with around 950 iQube dealerships, and expanding into international markets like LATAM and Morocco.

View and Valuation:

Considering the volatile global economic environment, including persistent inflation and elevated living costs, we revise our FY26/FY27 EPS estimates downwards by 3.3%/1.8%. Accordingly, we downgrade the stock to an ‘ADD’ rating with a revised target price of INR 2,920, valuing the core business at 34x FY27E EPS (maintained) and assigning a value of INR 168 to TVS Credit.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131