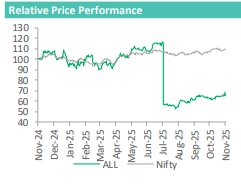

Hold Ashok Leyland Ltd for the Target Rs. 159 by ARETE Securities Ltd

Ashok Leyland (AL) reported a strong performance in Q2 FY26, reflecting its strategic focus on sustainable and profitable growth in the commercial vehicle sector. Revenue grew by +9.3% YoY to INR 9,588 crores, driven by higher volumes in both MHCV and LCV segments. EBITDA reached a record INR 1,162 crores, +14.2% YoY, with margins expanding by +52 bps to 12.1%, supported by effective cost-saving measures, stable material costs (71.2% of revenue), and improved realizations (+2% YoY). PBT also reached a record INR 1,043 crores, +23% YoY, driven by growth in higher-margin non-CV segments. PAT remained stable at INR 771 crores, flat YoY after adjusting for a negative variance of INR 157 crores from litigation provisions, which offset prior investment gains. Capex was moderated to INR 417 crores in Q2 (H1: INR 658 crores), reflecting disciplined expansion.

Updates of Subsidiaries and Segments

• Switch India delivered strong H1 performance with nearly 600 buses and 600 ELCVs sold, achieving both EBITDA and PAT positivity; its bus order book stood at 1,650 units at H1 end, while progressing toward free cash flow positivity by FY27.

• OHM scaled its E-MaaS operations to over 1,100 electric buses with 98%+ fleet availability, adding more than 250 units in Q2; it targets 2,500+ buses within the next 12 months, with all GCC projects at double-digit IRRs and active pursuit of the 10,000+ PM E-DRIVE tender.

• HLF and Hinduja Housing Finance expanded AUM by 26% YoY to 52,635 crore and 20% YoY to 14,903 crore respectively, posting Q2 consolidated PAT of ?196 crore and NNPA of 1.59%; HLF has secured final RBI clearance for its NXTDIGITAL merger, advancing toward listing as planned.

• Non-CV businesses advanced per strategy, with Aftermarket revenues up 11% YoY, Power Solutions up 14% YoY, and Defence up 25% YoY amid a robust order book and tender pipeline.

• Exports surged 45% YoY to 4,784 units in Q2 and 38% YoY in H1 across GCC, Africa, and SAARC, targeting 18,000 units for FY26 and 25,000 in the midterm through localized products and network expansion.

CV Segments: H2 Tailwinds from GST, Replacements, and Infra Push Ashok Leyland held 31% domestic MHCV share in H1 FY26 (+50 bps YoY, ex-defence/EVs) with Q2 volumes of 21,647 trucks/4,660 buses amid 4% industry growth, while LCV VAHAN share rose to 13.2% (+90 bps YoY) on 17,697 units (+6.4% YoY) and 13% 2-4 tonne surge; elevated fleet age (9.5-10.5 years) and BS-III/IV base, plus GST 2.0's 10% TCO cut favouring retail/small fleets, ignite replacement/last-mile demand. October's 7%/15% YoY MHCV/LCV upticks signal H2 outperformance (15%+ LCV pace), supported by infra-activities and increased CapEx, with LCV capacity expandable from 80,000 to 110-120,000 units via efficiencies.

Product Pipeline: Premiumization to Drive Margin Expansion AL is advancing its pipeline with a focus on premiumization and expansion of its non-diesel portfolio. They've launched commercial light e-trucks, three MHCV e-truck variants, and multiple e-bus models, alongside exploring CNG, LNG, and hydrogen. In the diesel segment, proprietary 6-cylinder engines have been introduced. Key upcoming launches include 320/360 HP trucks, 13.5m H6 buses, and 15m high-sleeper buses to meet rising demand. The SAATHI platform continues to capture 22-25% of 2-4T sales, targeting sub-2T upgrades, with a biofuel variant planned for release in 1-2 quarters. E-mobility advancements include 9m standard and low-floor buses, e-LCV trucks in FY27, and a shift in E1 production to RAK for cost efficiency. The BS-VI transition is driving demand for higher safety and comfort features, supporting strong volume and margin growth.

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM0000127