Buy Mahindra & Mahindra Ltd for the Target Rs. 4,122 by Motilal Oswal Financial Services Ltd

Healthy all-round earnings beat

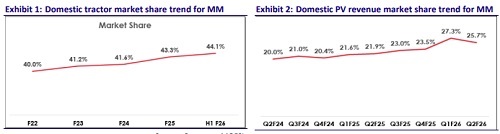

Tractor and SCV guidance raised, UV guidance maintained

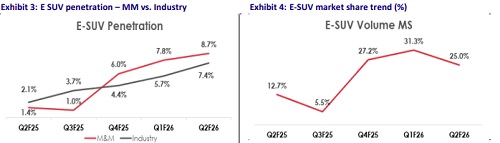

* Mahindra & Mahindra (MM)’s 2QFY26 PAT at INR45b was above our estimate due to better-than-expected margins (both from auto and FES segments), as well as higher other income. While the FES segment margin improved 220bp YoY to 19.7%, the auto segment margin improved marginally to 9.2% (despite EV ramp-up).

* While MM has outperformed its own targets of earnings growth and RoE of 18% in the past, it remains committed to delivering 15-20% EPS growth and 18% RoE. These targets ensure sustained profitability and shareholder value. We reiterate our BUY rating with a TP of INR4,122 (based on Sep27E SoTP).

Beat on margin both in the auto and farm segments

* MM’s revenue grew 21% YoY to INR334b (in line), led by 16% YoY growth in volumes.

* EBITDA grew 23% to INR48.6b (ahead of our estimate by 5%). EBITDA margin was marginally up YoY (+20bp) to 14.5% (Vs our estimate of 14%).

* While Farm PBIT margins improved 220bp YoY to 19.7% (est. of 18.8%), auto margins contracted marginally by 35bp to 9.2% (est. of 8.6%) due to the impact of contract manufacturing for e-SUV, excluding which margins improved 80bp to 10.3%. Farm EBIT margin was stable QoQ in a seasonally weak quarter, which was commendable.

* Within auto, while core ICE margins came in at 10.3%, e-SUV contract manufacturing delivered a 0.3% PBIT margin.

* Higher dividend income from its subsidiaries led to strong growth in other income, supporting a 17.7% growth in PAT for 2QFY26.

* While the Auto segment PAT grew 18% YoY to INR15.4b, the FES segment PAT jumped 54% YoY to INR11.6b during the quarter.

* CFO for 1HFY26 stood at INR78b, while capex stood at INR25b. Thus FCF for H1 stood at INR 53bn

* MM’s RoE for 1HFY26 stood at 19.4%, well ahead of its target of 18%.

* MM posted a revenue/EBITDA/PAT growth of 24%/22%/23.5% for 1H. For 2H, we expect MM to deliver a revenue/EBITDA/PAT growth of 18%/15%/ 20%.

Highlights from the management commentary

* While retail volume growth for MM was in the mid-to-high teens for this festive season, growth in bookings was even stronger.

* Management has maintained its mid-to-high teens volume growth guidance for SUVs for FY26.

* Further, LCV demand seems to have revived post the GST rate cuts. Management expects the momentum to be sustained in 2HFY26, and hence, it expects the industry to grow in the low double digits for FY26.

* Management has increased its FY26 tractor growth guidance for the industry to 10-12% from 6-7% earlier.

Valuation and view

* We believe MM is well placed to outperform across its core businesses, led by a healthy recovery in rural areas and new product launches in both UVs and tractors. We estimate MM to post a CAGR of ~16%/17%/19% in revenue/EBITDA/PAT over FY25-28E.

* While MM has outperformed its own targets of earnings growth and RoE of 18% in the past, it remains committed to delivering 15-20% EPS growth and 18% ROE, ensuring sustained profitability and shareholder value. Reiterate BUY with a TP of INR4,122 (based on Sep’27E SoTP).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412