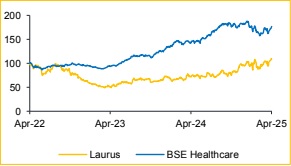

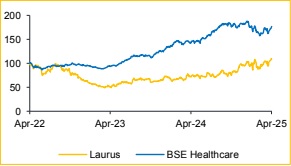

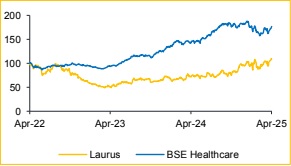

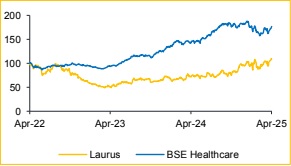

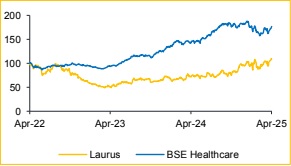

Buy Laurus Labs Ltd For Target Rs. 750 - Choice Broking Ltd

Upgraded to BUY on Strong CDMO Growth and Valuation Revision

Upgraded to BUY on Strong CDMO Growth and Valuation Revision We have slightly revised our estimates upward by 4.0%/2.7% for FY26E/FY27E, given the improved performance in the CDMO segment. We believe we are more optimistic compared to the street on CDMO business opportunity. Our view hinges on the following:

* We believe the CDMO arm is not just additive but transformational, with 110 active projects in the pipeline contributing significantly to segment growth.

* This recent traction aligns with higher utilization at newly built manufacturing blocks and the initial scale-up of CDMO volumes.

* Management has also indicated further margin improvement as the CDMO segment scales up. In light of this, we have valued Laurus using both DCF (refer to Exhibit 1) and PE multiple to determine a fair price range. Our PE valuation is based on a multiple of 40x on FY27E EPS (up from 37x earlier, reflecting the strategic shift towards CDMO). By averaging both DCF and PE valuations, we arrive at a target price of INR 750 and upgrade our rating to BUY

Broad Beat Backed by CDMO & Formulations; EBITDA Miss, API Dips:

Revenue grew 19.5% YoY / 21.6% QoQ to INR 17.2 Bn (vs. consensus estimate: INR 16.5 Bn). EBITDA increased 74.2% YoY / 47.5% QoQ to INR 4.3 Bn; margins expanded 768 bps YoY / 430 bps QoQ to 24.4% (vs. consensus: 25.2%). PAT surged 210.3% YoY / 150.5% QoQ to INR 2.3 Bn; PAT margin at 6.6%. One-off gain of INR 0.6 Bn in other income due to land sale to KRKA Pharma Pvt Ltd. Adjusted PAT (ex-one-off) stands at INR 1.7 Bn.

CDMO to Drive Long-Term Growth Backed by Pipeline & Capex:

The small molecule CDMO (Synthesis) segment continued its robust performance (+95.3% YoY / 15.3% QoQ), supported by multiple mid-to-late-stage deliveries and incremental contribution from new manufacturing assets. We believe this segment holds substantial growth potential, underpinned by a strong pipeline and recurring revenues from existing partnerships. The segment currently contributes 24.7% to revenue (up from 10.8% in FY21), and we expect this to increase to 31.7% by FY27Edriving meaningful improvement in EBITDA margins due to its high-margin nature.

API Recovery Expected from FY26 with Formulations Growth Boost:

After a recent decline, the API segment is set for a revenue recovery from FY26, as price erosion stabilizes and order books convert to sales. In formulations, new contracts and manufacturing lines coming online by Dec-25, and non-ARV formulations expected to accelerate from Q3FY26.

Management Call - Highlights

CDMO:

* CDMO positioned as core long-term growth engine for the company.

* Small Molecule CDMO grew 95% YoY, driven by strong demand from Big Pharma partners and ramp-up of new manufacturing blocks.

* Expect sustained high growth as more projects transition from clinical to commercial stages, with continued capacity expansion with multi-site infrastructure.

* Targeting broader project funnel with early-stage R&D focus; new small molecule R&D center to help onboard more innovation-stage clients.

API:

* ARV API + FDF revenue remained stable at INR 2,559 Cr, reflecting consistent order flow from global health programs.

* Non-ARV APIs, especially in oncology, underperformed; deemphasized in reporting due to low incremental value.

* ARV business expected to remain steady over the next 2–3 years, with Laurus retaining 40% market share in emerging markets.

Formulations:

* FDF revenue reached INR1,230 Cr in Q4; grew 27% QoQ and 5% YoY, driven by execution of multiple integrated CMO contracts.

* Continued growth in regulated markets, supported by scale-up in highvolume generic formulations.

* Non-ARV FDF to lead growth from Q3FY26 onward, with new launches in US and Canada and expansion with key CMO partners.

* KRKA JV progressing well; land acquisition complete, with facility construction to begin by June 2025. ? Focus on rebalancing R&D and manufacturing

Laurus Bio:

* Ongoing Phase 1 trials for both NexCAR-19 and a BCMA-based product.

* Scaling biologics operations with INR125 Cr investment in a GMP facility for ADC conjugation, plasmids, and viral vectors.

* Long-term aim to build a robust platform for next-gen therapeutics, and becoming a full-stack service provider in cell & gene therapy.

Others:

*Animal Health: Division moved forward with process validations; commercial operations yet to commence, expected to transition to full commercialization in FY26, leading to a significant jump in revenue contribution.

*Crop Sciences: First commercial delivery made post-commissioning; customer relationships in early engagement stages, division under development; meaningful traction and revenue ramp-up expected by FY26–27.

* Capex: FY26 CapEx planned at INR 800-1,000 Cr, mainly for fermentation and CMO expansions; debt expected to remain stable.

Outlook:

* Strong visibility in CDMO-led growth, supported by long-term programs and high-value clients.

* Clear roadmap to evolve into a fully diversified CDMO-CMO platform, covering small & large molecules, generics, animal & crop health.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131