Add UltraTech Cement Ltd For Target Rs. 13,162 - Centrum Broking Ltd

UTCEM reported mixed numbers for Q4FY25, with consolidated EBITDA/mt at Rs1,126, 7.5% below our expectation of Rs1,217/mt. The negative surprise was largely expected as it was th first quarter of consolidation of acquired assets of India Cements and Kesoram. However, the domestic business (excluding acquired assets) has reported EBITDA/mt of Rs1,270, which we believe is superior. Aided by acquisitions, UTCEM delivered robust 17% YoY growth in volume while volume growth (ex- acquisitions) was tepid at ~5% YoY. Consolidated net debt increased considerably from Rs27.8bn in FY24 to Rs176.7bn in FY25. During the year, the company added 16.30mn mt capacity organically (42.6mn mt including acquisitions), which is 57% of new capacity added by the cement industry. We believe that UTCEM will continue to deliver industry leading performance with continuous market share gains. We downgrade UTCEM to ADD from BUY with a revised target price of Rs13,162 given the recent uptick in the stock price.

Q4FY25 result highlights

UTCEM reported mixed numbers for Q4FY25 with reported EBITDA coming in at Rs46bn, up 12.3% YoY but it was 5.5% below our estimate. While volume growth was 2% above estimate, realization was muted due to a weak pricing environment in the South. Volume grew by 17% YoY to 41.02mn mt while consolidated realization stood at Rs5,622/t. Domestic grey cement realization improved marginally by 1.6% QoQ. Operating cost came in at Rs4,497/mt and was in line with estimate, but it was down by 3% YoY owing to stable Freight and Power & Fuel costs. Other expenses increased considerably owing to acquired assets. The company spent Rs94bn on capex and Rs108bn on acquisitions during the year. During FY25, the company added 42.60mn mt capacity through organic and inorganic means. The company’s global capacity now stands at 188.76mn mt.

Rs300/mt cost reduction plan for next two years

With multiple cost levers in place, UTCEM is focused on driving greater efficiency. Of the targeted Rs300/t cost reduction by FY27, Rs86/mt has already been achieved in FY25, largely helped by a reduction in primary lead distance from 402km in FY24 to 384km in FY25, resulting in savings of Rs44/mt. Additionally, the expansion of WHRS capacity from 278MW to 342MW contributed another Rs19/mt in cost savings. Further, out of Rs90-100bn capex for FY26, Rs15bn is towards India Cements with Rs10bn planned for WHRS capacity, benefits of which are expected to flow in from Jan–Mar’27. Increase in clinker-conversion factor, share of renewable power mix and increased usage of AFR are other drivers leading to cost reduction.

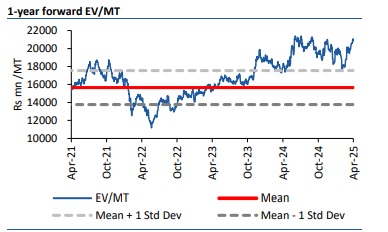

Downgrade to ADD post the recent uptick in stock price

We believe that UTCEM will continue to deliver industry-leading performance with superior volume growth and continuous improvement in costs. With the addition of assets from Kesoram and India Cements, along with recent price hikes in the South, we expect the company to benefit both on pricing and volume fronts. Further, we expect substantial improvement in the profitability of acquired assets over the next 3-4 quarters. We continue to value UTCEM at 18x FY27E EV/EBITDA to arrive at our target of Rs13,162. Key risk to our call include lower-than-anticipated demand, weak pricing environment and increase in P&F cost.

Valuation

We are building in 11%/19% CAGR in Revenue/EBITDA for UTCEM over FY24-FY27E. We value it at 18x FY27E EV/EBITDA to arrive at our revised target of Rs13,162.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331