Buy Ambuja Cement Ltd For Target Rs. 729 by Centrum Broking Ltd

Ambuja Cements reported good numbers for Q4FY25, with reported EBITDA of Rs19bn coming in 9% above our estimate. While results reflects a revival of margins from sequential quarter, the margin gap between peers still prevails. Strong volume growth (+13% YoY) and lower operating cost led to superior profitability. Revenue stood at Rs99bn, up 11% YoY while PAT came in at Rs11bn, up 8.5% YoY. The management reiterated its guidance of reaching 140mn mt capacity by FY28 and further guided for a reduction in operating cost per/mt to Rs3,650 by FY28. We believe that with multiple acquisitions completed during FY25, the next leg of growth will be led by organic capacity expansion and planned cost reduction measures. We continue to have BUY rating on Ambuja and value it based on 18x FY27 EV/EBITDA to arrive at our target price of Rs729.

Q4FY25 result highlights

Ambuja reported good numbers, with EBITDA/t at Rs1,002, 10% above our estimate of Rs907/t. This quarter, the company reported its highest volume and achieved cement capacity of 100mn mt. Further, it has completed the acquisition of Orient Cements. Revenue for Q4FY25 stood at Rs99bn, marginally lower vs our estimate of Rs101bn while volume came in at 18.7mn mt, 1% below our estimate. Operating cost at Rs4,299/mt was down sharply by 7% QoQ and 3% below our estimate. Sharp reduction in RM costs and other expenses resulted in better cost structure. Cash & cash equivalent stood at Rs101bn. 300MW of RE already commissioned and target of 1000MW RE by June’26 is on track.

Organic capacity addition to drive next leg of growth

During the last couple of years, Ambuja has acquired assets of multiple companies, thereby achieving cement capacity of 100mn mt in Q4FY25. Most of these strategic investments are into new assets, which will lead to higher efficiency in future. The company targets 118mn mt and 140mn mt of cement capacity by FY26 and FY28, respectively. We believe that the next leg of growth will come from commissioning of multiple brownfield expansions and increasing capacity utilization of acquired assets. For FY26, capex is pegged at Rs90bn, out of which Rs60bn will be growth capex while Rs30bn will be towards efficiency improvement. Consolidated cash & cash equivalent stood at Rs101bn.

Operating cost measures will lead to EBITDA expansion

The management holds the guidance of Rs100/t and Rs150/mt cost reduction in FY26 and FY27, respectively and aims to bring operating cost down to Rs3,650/mt by FY28. This improvement in cost will be led by following measures: (1) Better fuel management, increased AFR share and WHRS capacity (2) Fly ash supply from Adani Power plant (3) Reduction in lead distance and improved share of Rail & Marine transport, leading to lower transportation costs and (4) Low cost import of Petcoke. With these cost reduction plans in place and anticipation of better realisation, the management has guided for EBITDA/mt of Rs1,500 in FY28.

Valuation and outlook

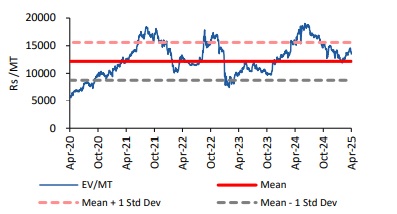

We are building in 18.4%/40.4% CAGR (on a weak base) in Revenue/EBITDA over FY25-27E. We have factored in EBITDA/mt of Rs1,146 in FY27 vs Rs769 in FY25 owing to planned cost control measures and increased utilization of acquired assets. We value Ambuja at 18x FY27 EV/EBITDA to arrive at our target price of Rs729. We maintain our BUY rating. Further, sustained weakness in demand and prices, delay in capacity additions and increased competition remain key downside risks to our call.

Valuation

We are building in 18.4%/40.4% CAGR in Revenue/EBITDA for Ambuja over FY25-27E. We value it at 18x FY27 EV/EBITDA to arrive at our target price of Rs729.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331