Add Maruti Suzuki India Ltd For Target Rs. 12,410 - Choice Broking Ltd

EBITDA Miss; Revenue and PAT in-line, led by in-line volume growth and a slightly lower than expected ASP

* Revenue was up 6.4% YoY and up 5.7% QoQ to INR 4,06,738Mn (vs CEBPL est. at INR 4,17,353Mn) led by 3.5% YoY growth in volume (in-line) and 2.3% YoY growth in ASP (lower than expected). Volume growth was driven by 8.1% YoY growth in exports.

* EBITDA was down 9.0% YoY and down 4.6% QoQ to INR 42,647Mn (vs CEBPL est. at INR 48,830Mn). EBITDA margin was down 177bps YoY and down 113bps QoQ to 10.5% (vs CEBPL est. at 11.7%).

* APAT was down 4.3% YoY and up 5.3% QoQ to INR 37,111Mn (vs CEBPL est. at INR 37,638Mn).

EBITDA Margin Impacted by Ramp-Up Costs and EV Launch; Normalization Expected Ahead: EBITDA margin for Q4FY25 declined to 10.5% from 12.3% in Q4FY24, primarily due to higher expenses related to the new Kharkhoda plant (which began production in Mar-25), adverse commodity costs (mainly steel), an unfavorable product mix, and increased advertising spend for the e-Vitara unveil. We expect the EBITDA margin to normalize going forward as the plant ramps up production in the coming quarters. The EV segment which is set to begin sales in H1FY26 with an expected 3–4% penetration by FY26 may have a slight drag on the margin due to much lower profitability compared ICE vehicles.

Exports emerge as key growth driver for MSIL in FY25 and beyond: Exports for the quarter stood at 85,220 units, and for FY25, exports stood at 3,32,585 units, showcasing a growth of about 17.5% over FY24. MSIL commanded nearly a 48.4% share of India's total passenger vehicle exports in Q4FY25. MSIL also plans to export its first electric SUV, the e-Vitara, to around 100 countries. We believe that exports will play a crucial role for MSIL and provide a cushion when domestic growth is currently slow. MSIL has been successful in its efforts to increase exports, and we expect growth momentum to continue with the revenue from the export segment to grow by 22%/22% for FY26/FY27

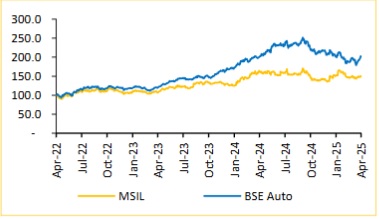

View and Valuation: MSIL has a large distribution network; largest low emission product portfolio with new launch in the EV segment and growing export volumes. However, the domestic PV industry is expected to have lower single digit growth for FY26. Keeping in mind the volatile global economic scenario amid prevalent issues like inflation and rising cost of living, we revise our FY26/27 EPS estimates downwards by 3.8%/3.0% and downgrade to a ‘ADD' rating with a revised target price of INR 12,410, valuing the company at 22x (previously 24x) on FY27E EPS.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131