Buy Federal Bank Ltd For Target Rs. 217- Centrum Broking Ltd

NII for Q4FY25 came in at ~Rs24bn (up +8% YoY/down 2% QoQ), which was below our estimate of Rs26bn. Net advances and deposits saw a sequential rise of 2% and 6.5%, respectively. CTI was higher at 56.7% vs. 62.3%/53.1% in Q4FY24/Q3FY25. PPoP at Rs14.7bn was up by 32% YoY/down 7% QoQ due to higher opex. Credit cost stood 38bn at 24bps vs. 51bps in Q3FY25. Resultantly, PAT came in at Rs10.3bn, up 8% QoQ. CRAR came in at 16.4%. GNPA and NNPA were lower QoQ at 1.84% and 0.44%, respectively thanks to higher recovery (~Rs4.3bn). The bank, under its new CEO, is strategically shifting focus away from growth driven by high-value, large-ticket deposits. Instead, it aims to enhance its deposit profile by emphasizing on retail deposits and CASA, which are more stable and cost-effective. While commendable for long-term value creation, the strategy entails slower medium term growth reflected in tepid advances growth. Further, the focus on granular deposits comes at a time when even banks with stronger brands and wider distribution networks are struggling to achieve substantial growth in low-cost deposits. This indicates a challenging environment for the bank’s recalibrated strategy. We continue to maintain our ADD rating, with a target price of Rs217 (previous TP: Rs219), assigning a 1.25x multiple to FY27E ABV.

Cost efficiencies

The management targets a CTI of ~53–54% in FY26, with Q4FY25 opex elevated due to one-offs. Federal Bank is targeting cost efficiencies to improve its CTI ratio and profitability by centralizing routine tasks, utilizing AI-driven automation and enhancing branch productivity. Notably, the journey began with the establishment of its first FedServ in 2018, but the anticipated benefits in CTI improvement are yet to materialize and reflect in numbers.

Higher growth on deposit front as recalibration of strategy takes over

Net advances and deposits grew by 2% and 6.5% QoQ, respectively as the bank continues to focus on driving better-quality deposit growth by leveraging the bank’s brand strength and extensive distribution network to fund advances. CASA ratio increased by 7bps QoQ to 30.23% (29.38% in Q4FY24). Further, the LDR ratio stood at comfortable levels of ~83%. The bank will now focus on mid-yielding secured retail assets to support NIM and rebalance its loan mix.

Decent Return profile and pristine asset quality

Bank continues to report pristine asset quality performance, with Gross NPA at 1.84% (down 11 bps QoQ) and Net NPA stable at 0.44%. The PCR was strengthened to 75.37%, reflecting a YoY improvement of over 400 bps. Credit costs for FY25 stood at 38 bps, in line with prior guidance (35–40 bps), supported by strong recoveries and a prudent approach to unsecured lending. Despite macro uncertainties, the bank maintained resilient profitability, with ROA improving to 1.24%, up 2 bps YoY, and ROE at 12.82%, highlighting effective risk-adjusted growth and strong operational discipline.

Valuation and recommendation: Maintain ADD

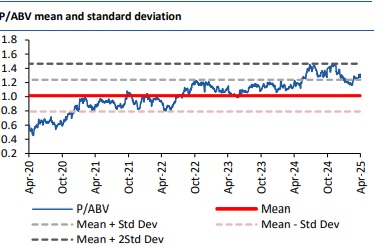

The pivot in long term strategy is the right move for the long term, but it will weigh on near term growth and returns. Federal Bank’s strategic roadmap is comprehensive but ambitious, with execution risks outweighing potential upside in the near term. We advise investors to wait and watch until clarity emerges on execution and competitive dynamics. As a result, we maintain our ADD rating, with a target price of Rs217 (previous TP: Rs219), assigning a 1.25x multiple to FY27E ABV. Modest valuation multiple reflects the current trade-offs between growth and long term value creation. Key risks: Higher-than-expected credit growth, NIM expansion, and cost optimization gains.

Valuation

We continue to maintain our ADD rating, with a target price of Rs217 (previous TP: Rs219), assigning a 1.25x multiple to FY27E ABV.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331

.jpg)