Buy Avalon Technologies Ltd for the Target Rs. 1,030 by Motilal Oswal Financial Services Ltd

Healthy growth momentum continues across geographies

In-line operating performance

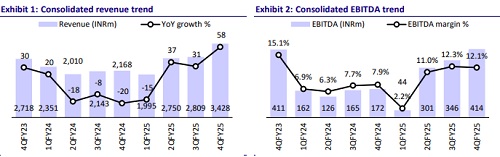

* Avalon Technologies (AVALON) reported a strong quarter, with revenue growing 58% YoY in 4QFY25, fueled by a stellar performance in the India (+73% YoY) and US (+47% YoY) businesses. EBITDA improved (+410bp) due to a rise in domestic manufacturing (87% vs. 77% in 4QFY24) and favorable operating leverage.

* The company is witnessing growth across all the business segments, with the orderbook growing 29% YoY (INR17.6b). AVALON is expanding its manufacturing footprint and is also entering into strategic collaborations (with companies like Zepco) to enhance profitability. As a result, management has guided for an 18-20% YoY revenue growth with an expected gross margin of 33-35%.

* We broadly maintain our EPS estimates for FY26/FY27. Reiterate BUY with a TP of INR1,030 (premised on 43x FY27E EPS).

Operating leverage underpins EBITDA margin expansion

* AVALON’s consolidated revenue grew 58% YoY to INR3.4b, driven by growth in both the domestic (up 73% YoY due to traction in the mobility and clean energy businesses) and US (up 47% YoY) businesses.

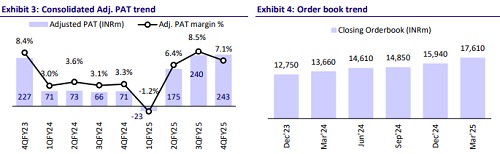

* Gross margin contracted 250bp YoY to 35%, led by a change in the product mix (the management had previously guided for a sustainable gross margin range of 33-35%). Consolidated EBITDA surged 2.4x YoY to INR414m, with EBITDA margin expanding 410bp to 12.1%, driven by operating leverage. This was reflected in a 420bp YoY decline in employee expenses as a percentage of sales to 16.6% and a 240bp decline in other expenses to 6.4%. Consequently, the company reported an adjusted PAT of INR243m, marking a 3.4x jump YoY.

* The total order book stood at INR28.8b with the short-term order book (executable within 14 months) at INR17.6b (up 29% YoY/11% QoQ) and the longer executable order book (from 14 months up to three years) at INR11.23b (up 18% YoY).

* Gross debt as of Mar’25 was INR1.4b vs. INR1.6b as of Mar’24. Net working capital days dipped to 124 from 150 days as of Dec’24, led by lower inventory days (down 17 days) and trade receivables days (down 10 days).

* In FY25, revenue/EBITDA/Adj. PAT increased 27%/77%/2.2x YoY to INR10.9b/INR1.1b/INR634m.

Highlights from the management commentary

* Guidance & outlook: Management has guided an 18-20% growth in revenue, with significant growth anticipated in 2HFY26. AVALON has secured several new projects that have moved from the design/prototype stage to the production stage. Many of these are expected to ramp up in the current financial year.

* Collaboration with Zepco: AVALON is enhancing its technical competence via strategic collaborations, including its partnership with Zepco Technologies. Zepco is involved in the design and manufacture of motors, drives, controllers, and power solutions, serving sectors such as drones, EVs, and defense.

* Capex. AVALON plans to incur a capex of INR450-500m in FY26, which may include capex on a new export facility in Chennai and a domestic facility located ~30km away from the existing Tamil Nadu facility. The capacity expansion is done to take care of the large businesses expected to come into India from the European and GCC customers, which are currently being dominated by Japanese customers.

Valuation and view

* With the company witnessing growth across both the Indian and US businesses, we expect AVALON’s revenue and profitability to experience a healthy improvement going forward.

* Further, the company’s long-term revenue trajectory is anticipated to be strong, backed by: 1) the addition of new customers in the US and Indian markets, 2) order inflows from the high-growth/high-margin industries, such as clean energy, mobility, and industrials, 3) strategic collaborations, which will enhance competence and margin, and 4) venturing into advanced technology segments.

* We estimate AVALON to post a CAGR of 28%/40%/58% in revenue/EBITDA/adj. PAT over FY25-FY27 on account of strong growth and healthy order inflows. Reiterate BUY with a TP of INR1,030 (premised on 43x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412