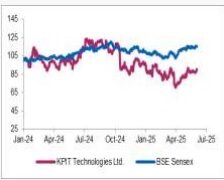

Buy KPIT Technologies Ltd For Target Rs.1,385 by Axis Securities Ltd

Mix Bag Performance; Revenue Visibility Ahead

Est. Vs. Actual for Q1FY26: Revenue – INLINE ; EBIT margin – MISS; PAT – MISS

Recommendation Rationale

* Demand Outlook: Demand among OEMs is increasing as they recognise the need to catch up quickly with better quality and faster validation processes. AI-driven validation solutions remain a key priority for OEMs.

* Deal Wins/Pipeline: Deal wins have grown strongly (~20% on a TTM and YoY basis), driven by factors such as reprioritisation of existing programs and rising demand for more efficient, solution-based delivery.

* AI Competencies: KPIT remains highly optimistic about its AI competencies and the solutions being developed, particularly in AI-infused mobility. Management believes the company’s advanced AI journey in mobility provides a significant competitive edge in winning new business.

Sector Outlook: Cautiously optimistic

Company Outlook & Guidance: The company remains confident in its strategy and ability to navigate the evolving mobility industry landscape, leveraging its technological prowess and strategic partnerships to drive future growth.

Current Valuation: 33x FY27E P/E

Current TP: 1,385/share

Recommendation: With a deal pipeline across business verticals, new partnerships, and higher adoption of new-age technologies, the company is expected to show better recovery. Hence, we resume our coverage with a BUY rating on the stock.

Financial performance

In Q1FY26, KPIT Technologies reported revenue of Rs 1,539 Cr vs Rs 1,365 Cr in Q1FY25, up 12.7% YoY and 0.7% QoQ. EBIT stood at Rs 237 Cr vs Rs 236 Cr in Q1FY25, up 0.4% YoY and down 10.5% QoQ. EBIT margin declined by 190 bps YoY and 192 bps QoQ to 15.4%. Net Income came in at Rs 172 Cr vs Rs 205 Cr in Q1FY25, down 16% YoY and 29.7% QoQ. In CC terms, revenue grew 4.9% YoY and declined 3.2% QoQ. The Total Contract Value (TCV) during the quarter stood at $241 Mn vs $202 Mn in Q1FY25, up 19% YoY and down 14% QoQ.

Valuation & Recommendation

The management expects geopolitical issues to settle down within a quarter and expects H2 to see higher performance than H1, with growth momentum, particularly driven by its top 25 clients. We are constructive on the long-term outlook of the company. Hence, we resume over coverage with a BUY rating on the stock and assign a 33x P/E multiple to its FY27E earnings to arrive at a TP of Rs 1,385/share, implying an upside of 10% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633