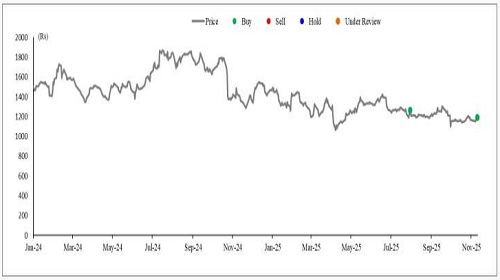

Buy KPIT Technologies Ltd For Target Rs. 1,350 - Axis Securities Ltd

Impact of Acquisition Spends; Significant Recovery from FY27

Est. Vs. Actual for Q2FY26: Revenue – INLINE ; EBIT – MISS; PAT – MISS

Change in Estimates YoY post Q2FY26:

FY26E/FY27E: Revenue: -1.4%/-0.7%; EBIT: -3.2%/0.6%, PAT: -2.6%/-0.8%

Recommendation Rationale

* Macro Environment Outlook: The overall macro environment has shown a marked improvement, with uncertainty levels reducing by over 50% compared to Q4FY25. Europe displayed strong traction during the quarter as clients began transitioning their supply chains from local to more globally integrated ecosystems.

* Deal Wins/Pipeline: The company announced a major multi-year, multi-domain deal from a leading European OEM. Only a small portion of this deal was factored into the current quarter’s performance, with meaningful ramp-ups expected in the subsequent quarters, enhancing revenue visibility over the medium term.

* AI Competencies: KPIT remains highly confident about its AI-led capabilities, particularly in AI-driven mobility solutions. Management emphasized that the company’s advanced AI initiatives in mobility continue to provide a strong competitive advantage in securing new business opportunities.

Sector Outlook: Cautiously optimistic Company Outlook & Guidance: The company remains confident in its strategy and ability to navigate the evolving mobility industry landscape, leveraging its technological prowess and strategic partnerships to drive future growth.

Current Valuation: 35x FY27E P/E (Earlier Valuation: 33x FY27E P/E)

Current TP: 1,350/share (Earlier TP: Rs 1,385/share)

Recommendation: We maintain our BUY rating on the stock.

Financial performance

In Q2FY26, KPIT Technologies reported revenue of Rs 1,588 Cr, up 8% YoY and 3.3% QoQ. EBIT remained flat YoY at Rs 246 Cr due to additional depreciation cost of Rs 43 Mn on account of Caresoft intangibles amortization, though it rose 3.8% QoQ. EBIT margin declined by 121 bps YoY and remained flat QoQ at 15.5%, impacted by higher operating expenses. Net income declined 17.1% YoY and 1.6% QoQ to Rs 169 Cr, owing to higher finance costs and losses from associates/JVs (Qorix & NDream). In CC terms, revenue grew 0.4% YoY and 0.3% QoQ. The company closed the quarter with a cash balance of Rs 10.5 Bn and DSO at 49 days (ex-Caresoft: 44 days), which is expected to normalize post integration. Total Contract Value (TCV) stood at $232 Mn vs $241 Mn, down 4% QoQ.

Valuation & Recommendation

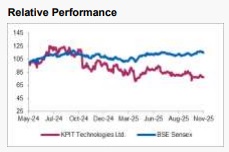

KPIT aims to expand into adjacencies such as off-highway, industrial, defense, and micro-mobility segments, while continuing to invest in AI-led solutioning and next-gen mobility technologies to sustain long-term profitable growth. H2FY26 is expected to perform better, driven by improved demand and execution compared to H1FY26, with a more favorable outlook from FY27 onwards. The company is valued at 35x P/E multiple on FY27E earnings, leading to a TP of Rs 1,350/share, implying an upside of 14% from the CMP. We maintain a BUY rating on the stock.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633