Buy Jupiter Life Line Hospitals Ltd For Target Rs.1,800 by Prabhudas Liladhar Capital Ltd

In-line quarter; bed expansion on track

Quick Pointers:

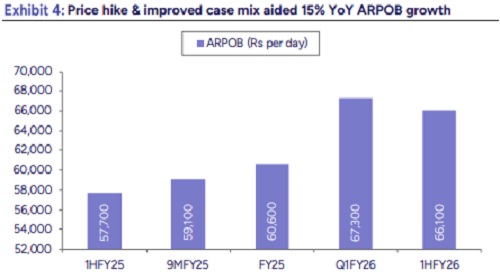

* ARPOB grew by 15% YoY aided by case-mix and price revisions

* On track to add 1,440 beds to reach total 2,500 bed capacity.

JLHL’s Q2 consolidated EBITDA adjusted for one offs grew by 9% YoY to Rs850mn. Its operational efficiency has been strong in the competitive markets of MMR. The company reported revenue/EBITDA CAGR of 20%/25% over FY22-25. Given its expansion plans, scale-up in occupancy and improving margins, growth momentum is expected to sustain over the medium term. We believe strategic greenfield expansions in densely populated micro-markets of western regions will drive sustainable growth. Our FY27E and FY28E EBITDA stands reduced by 3-5% as we factor in lower margins. Overall, we see 19%/14% CAGR in EBITDA/PAT over FY25-28E with healthy return ratios of ~16%. Maintain ‘BUY’ rating with a TP of Rs1,800/share, valuing at 26x EV/EBITDA based on Sept 2027E EBITDA as we roll forward.

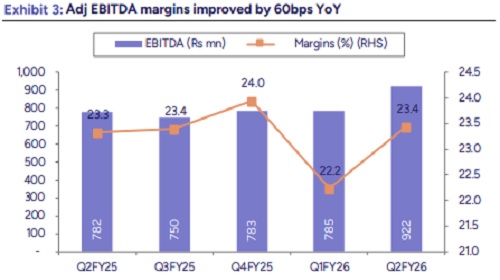

* In-line EBITDA: JLHL Q2FY26 EBITDA increased 18% YoY to Rs 922mn. There were certain one offs- unbilled revenues of Rs 192mn and related provision of Rs 123mn. Adjusted for this EBIDTA growth was 9% YoY to Rs850mn. The company has also restated prior-quarter numbers. Adjusted OPM improved 60bps QoQ and declined 50bps YoY to 22.8%. EBITDA growth was 14% YoY for 1HFY26. Reported PAT came in at Rs 574mn, up 11% YoY; adjusted for unbilled revenues, PAT was flat YoY.

* Strong ARPOB; YoY occupancy declines due to new bed addition: JLHL reported revenue growth of 18% YoY to Rs3.9bn. Adjusted for unbilled revenues, grew ~12% YoY to Rs 3.75bn. The product mix shift led to a 100bps YoY improvement in gross margins. ARPOB continues to improve by 15% YoY to Rs66.1k per day in H1, driven by case-mix improvement at Indore, insurance tariff revisions, and inflation-linked pricing. Occupancy decreased by 500bps YoY to 62.2% in H1, given 78 new beds added during the year. IP volumes decreased by ~3% YoY. While OP volumes increased 11% YoY in Q2.

* Key con-call takeaways: The company continues to be on track to achieve its initial target of 2,500 beds by adding ~1,440 beds across 6 hospitals in Western India in the next 3-4 years.

* Bed expansion plan – Greenfield project at Dombivli (500beds) is on track, construction work is progressing well and ~250 beds are expected to be operational in Q1FY27. While reiterating the guidance on breakeven in 2nd year of operations. Mgmt expects strong demand ramp-up and EBITDA breakeven in year 2 due to large catchment with no major organized player.

* The second hospital in Bibwewadi, Pune, construction planned to commence in Q3FY26. While Mira-Bhayandar hospital is under design finalization. Management reiterated that new hospitals typically remain EBITDA-negative in year 1 and breakeven by year 2 (~40–45% occupancy).

* Capex: Rs 1.1bn capex was incurred in H1FY26.

* Net debt – Consolidated debt stood at Rs 3.25bn as of Q2FY26, offset by Rs 5.5bn in liquid investments, indicating a net cash position of Rs 2.25. Cost of borrowing is 7–8%, though the effective carrying cost is ~1% due to investment income. Internal accruals and existing liquidity are expected to fund ongoing projects, with incremental borrowing only if additional expansion opportunities arise.

* Thane unit - Mature unit with stable mid-70% occupancy and steady margins.

* Pune Unit: Margins improving; occupancy approaching 70%, though Q2 saw a mild seasonal dip due to lower infection-related admissions.

* Indore unit - Ramp-up continues with benefiting from case-mix optimization and rate revisions, driving ARPOB growth.

* Unbilled revenue accounting introduced this quarter (Rs192mn revenue, Rs 123mn professional fee impact). Professional fees increase in Q2 was largely one-off due to policy change and provisioning.

* Guidance for FY26E - FY26 growth momentum expected to remain steady with mature hospitals sustaining mid-20% EBITDA margins. Margins could temporarily dilute upon commissioning of Dombivli in FY27, before normalizing as ramp-up progresses. No new inorganic opportunities are currently under evaluation; focus remains on Western India (Maharashtra, Gujarat, MP).

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271