Buy Infosys Ltd For Target Rs. 1,800 By JM Financial Services

INFO’s 2Q revenues (+2.2% cc QoQ), like other peers’ who have reported thus far, were ahead of expectations (JMFe: 1.7%). EBIT margins however missed (21% vs JMFe: 21.3%), though explained by reversal of a one-off benefit (70bps). INFO narrowed its revenue guide from 1-3% to 2-3%, implying -1.2% to +0.1% CQGR over 2H (JMFe). INFO attributes this (soft 2H) to seasonal factors. INFO does have pronounced seasonality. Its 2H outlook however, we believe, reflects recency bias and a bit of conservatism. Recency bias, because INFO’s 4Q in past two years has been particularly weak (albeit due to specific factors), possibly influencing its guidance this year too. Conservative because a) 1HFY25 was much stronger making the 2H vs 1H comp easier for FY26; b) 1HFY26 TCV/Net new TCV is up 5%/24% YoY which should aid 2H growth; and c) INFO has closed USD 1.6bn NHS deal in October which is 100% net new (ACV: USD 107mn) and will ramp up in 2H. We estimate this deal alone can add 50bps to 4Q revenues. Besides, 12,000 fresher addition in 1H and 8,000 net headcount addition in 2Q (+2.5% QoQ) also point to improved visibility. Moreover, INFO has not built any improvement in demand environment even at the upper-end of its guide. We therefore see scope of guidance upgrade. We have built 3.7% cc YoY growth for FY26E. Our FY25-27E EPS however is little changed (-1% to +2%). That said, at 19x FY27E PER, we find risk-reward favourable. BUY.

* 2QFY26 growth – Topline beat: INFO reported 2.2% cc QoQ rev growth versus JMFe/Cons. est. of 1.7%/1.8%. Acquisitions contributed 20bps. Growth was led by increased realisations. Among verticals, Hi-tech (+9% QoQ USD), Manufacturing (+5.3%), Communications (+3.6%) and BFSI (+2.0%) led the growth. Retail was the only vertical to see a decline (-2.6% QoQ). EBIT margins improved 20bps to 21.0%, missing estimates (JMFe: 21.3%). Currency (+60bps), Project Maximus (+30bps) including improved realisations offset by increase in subcon were tailwinds. Higher post-sales customer support and other expenses (-70bps) were headwinds. PAT came in at INR 73.6bn in-line with Cons. est. of INR 73.0bn (JMFe: INR 73.0bn). Utilization was stable at 85.1%- near management’s comfort range. Despite 2H being seasonally soft due to furloughs, INFO added 7.8k people, this was attributed to demand visibility.

* FY26 guidance - narrowed: INFO revised its FY26 cc revenue growth guidance from 1-3% earlier to 2-3% now. Recent acquisitions – MRE and The Missing Link – will likely contribute c.50bps to this, implying organic guidance of 1.5-2.5%. 2-3% guidance translates into (1.2%)- 0.1% CQGR through 3Q-4QFY26. Though weak, INFO’s pronounced seasonality makes CQGR maths irrelevant, in our view. We take comfort in the fact that INFO has not built any macro improvement even at the upper end. Deal wins were strong at USD 3.1bn, +28% YoY. Importantly, 67% of the deals won were net new. The USD 1.6bn deal won from NHS in October is 100% net new and should drive growth as it ramps up. Market share gains and increased win ratio in vendor consolidation offer further comfort. Margin guidance was retained at 20-22%. Management does not expect any near term margin impact from H-1B. Over the long term, delivery models will shift to a combination of nearshore, offshore and localisation.

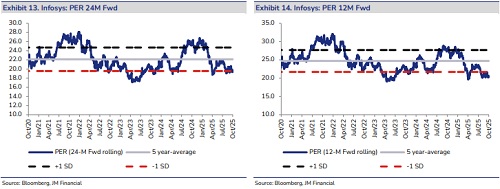

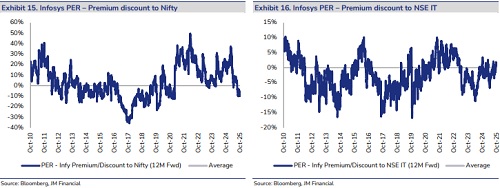

* EPS largely unchanged; Retain BUY: We see scope for guidance upgrade and build 3.2% organic cc growth for FY26E (vs. c.2.1% earlier). 2Q beat, headcount addition, NHS mega deal and increase in net new deals drives our optimism. Our margin are largely unchanged, we build 21.1% margin for FY26E, at the midpoint of the guided range. EPS estimates are largely unchanged, We have revised our EPS by -1%-2%. INFO is trading at 19x FY27E, making the risk-reward favourable, in our view. Maintain BUY.

Key Highlights from the call

* Demand: INFO reported 2.2% QoQ (20bps from acquisition) and 2.9% YoY growth in constant currency, with broad-based growth across verticals and geographies (four of five verticals and three of four geographies grew YoY). Growth was driven by realization improvement under Project Maximus, while volumes remained soft. Manufacturing and Financial Services were key contributors, each growing >5% YoY in cc terms. Management highlighted continued marketshare gains, supported by vendor consolidation and clients’ focus on AI-led modernization and cost optimization. While discretionary spending across Retail, Hi-Tech, and Communications remains muted, management noted healthy deal momentum and strong large-deal pipeline, aided by enterprise AI traction and expanding forward-deployed engineering teams.

* Outlook: INFO raised its FY26 revenue growth guidance to 2–3% cc (earlier: 1–3%) and retained EBIT margin guidance of 20–22%. The outlook factors in seasonal softness in H2 (lower working days, furloughs) and macro uncertainties from tariffs and geopolitics. Management highlighted that pipeline visibility remains strong, underpinned by recent mega deal wins, resilient client spending on AI modernization, and sustained large-deal momentum. Revenue from the Versent JV (Australia) are excluded from current guidance.

* Margin: Operating margin improved 20bps QoQ to 21%, driven by 60bps benefit from currency and 30bps from Project Maximus (value-based pricing and lean automation), partly offset by 70bps headwind from higher post-sales support costs and other expenses. Gross margins remained resilient at 30.8% in 1H. Utilization (ex-trainees) stayed stable at c.85%, within the management’s comfort range. Management reiterated its FY26 EBIT margin guidance of 20- 22% and highlighted multiple levers- realization improvement, offshore mix, Maximus efficiency, and third-party cost optimization-offset by large-deal transition costs.

* Bookings: Large deal TCV stood at USD 3.1bn in Q2 (67% net new), with a USD 1.6bn mega deal (NHS) announced post quarter close. INFO signed 23 large deals during the quarter-six in Financial Services, four each in Manufacturing, Retail and Communication, three in EURS, and one each in Hi-Tech and Others. Regionally, 14 deals came from the Americas, seven from Europe, and two from ROW. Deal composition continued to be led by vendor consolidation, AIdriven productivity, and cost optimization themes, while smaller deal activity remained subdued. Management emphasized a disciplined approach to large deals with margin guardrails in place.

* Segments: Financial Services sustained strong momentum, with six large deals led by modernization and AI-driven transformation in mortgages, capital markets, and commercial banking. Banks continue to invest in AI infrastructure, with several projects transitioning from POC to enterprise scale. Manufacturing saw >5% YoY cc growth, driven by digital programs, infra rationalization, and AI-led productivity initiatives that offset pricing deflation in automotive. EURS benefitted from cost takeout and vendor consolidation opportunities amid energy transition and grid modernization demand. Retail remained cautious given tariff uncertainty, but transformation initiatives in marketing, cloud, and operating-model productivity continue under Topaz. Communication vertical remained subdued amid high CapEx pressures, with selective investment in AI automation and CX transformation. Hi-Tech faced budget cuts and program closures, though semiconductor-related AI opportunities are gaining traction.

* Gen AI: INFO reinforced its position as a leading enterprise AI services provider, delivering over 2,500 AI and 200 Agentic AI projects. Its AI-first strategy, launched in 2023, focuses on making employees AI-amplified and embedding forward-deployed engineers with clients to drive transformation. Infosys Topaz-via Services.AI for IT modernization and Client.AI for business transformation- anchors its enterprise AI delivery. Proprietary Small Language Models (SLMs), Responsible AI Office (ISO 42001-certified), and partnerships with hyperscalers and academia underscore its differentiated positioning in AI-led productivity and revenue enablement.

* Wage hike: Headcount increased by c.8k QoQ to 332,000, with 12,000 freshers added in H1 to meet improved demand visibility. Attrition remained low at 14.3%, and utilization held stable at c.85%. Management reiterated its reduced dependence on H-1B visas through higher local hiring, university partnerships, and expansion of near-shore delivery hubs across the US, Canada, and Mexico, aimed at enhancing delivery resilience and mitigating future visa-related risks.

Valuation charts

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361