Debt Market Watch 22nd December 2025 by GEPL Capital

Government Security Market Update:

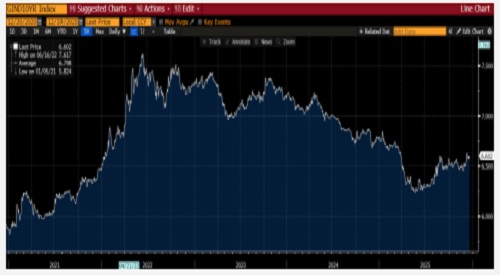

Indian government bond moved in the range of 6.57 to 6.62% despite the Reserve Bank of India announced the outgoing benchmark 6.33% GS 2035 & longer end 7.09% GS 2054 part of the basket of the Rs.50,000 crore OMO Purchase. Last Thursday, the RBI bought a similar quantum at higher-thanestimated prices and traders anticipating the similar move from the RBI in this week OMO. The RBI bought 6.75% GS 2029; 6.10% GS 2031; 6.54% GS 2032; 7.18% GS 2033; 6.33% GS 2035; 7.23% GS 2039 & 7.09% GS 2054 at a yield of 6.1637; 6.4237; 6.4983; 6.6180; 6.5875; 6.9607 & 7.2983% respectively. Bond yields have largely risen over the last few days, even after the RBI eased the repo rate by 25 bps and announced an infusion of Rs.1 lakh crore through OMO Purchase. Foreign investors have net sold $1.1 billion worth of bonds so far in December, which pushed yield higher. Earlier in a week the ten states sold 4 to 30 years loans in the range of 6.77 to 7.61% and in the Treasury bill auction the Reserve Bank of India sold 91; 182 & 364 DTB at a yield of 5.2780; 5.4961 & 5.5044% respectively. In a weekly auction the government sold 6.01% GS 2030 & 7.09% GS 2074 at a yield of 6.3527 & 7.3702% respectively. The yield on the 6.48% Government bond due Oct. 2035 rose to 6.6017% from 6.5931% last week.

Global Debt Market Update:

The benchmark 10-year Treasury yield moved lower on Thursday as investors digested delayed inflation data that showed cooling price pressures. The yield on the 10-year Treasury fell more than 3 basis points to 4.118%. The 2-year Treasury yield declined by more than 2 basis points to 3.46%. The 30-year Treasury bond yield slid more than 2 basis points to 4.80%. The consumer price index rose at a 2.7% annualized rate last month. Core CPI, which strips out volatile food and energy prices, was also cooler than anticipated, increasing 2.6% over 12 months. It was expected to have increased by 3%. The labor market, new data showed initial jobless claims fall to 224,000 for the week of Dec. 13, down from the previous week when initial claims were 237,000. The downward trend in inflation gave investors some hope that the Federal Reserve will lower rates in 2026. While odds for a January rate cut remain low, traders are pricing in a 56.8% chance of a March reduction, according to the CME.

Bond Market Ahead:

The Indian 10-year benchmark bond consolidated in the range of 6.57 to 6.62% with a strong buying from the Reserve Bank of India through OMO indicates the strong rally ahead. The RBI MPC minutes indicates that the RBI is not done with the interest rates and more easing on the way. Even after the 25 bps repo rate cut to 5.25% in early December, the MPC sees scope for additional rate cuts in 2026 if current trends continue especially subdued inflation and slower growth expectations. The minutes reinforce a dovish undertone beyond the December policy cut. Downward pressure on yields, especially in the 5–10 year segment, markets are likely to price in at least one more rate cut over the next 2–3 MPC meetings. The MPC Minutes validate the bond market’s bullish narrative. Inflation is no longer the constraint growth risks are. RBI may not rush, but the next policy move is more likely a cut than a hike. The strong demand in the longer end segment in Friday's auction indicates the return of the longer term investors (Insurance; pension; PF and others) to the market and spread which has already squeezed by 10 bps from the last week will narrow further going forward. The RBI has also kept the door open for OMO Purchase and may announce another Rs.1 lakh crore of purchase through OMO in January 2026, which will bring down the yields further and will provide depth to the market.

Bond Strategy:

* Buy 6.48% GS 2035 around 6.59 to 6.60% with a target of 6.56 and a stop loss of 6.63%

* Buy 6.01% GS 2030 around 6.35 to 6.36% with a target of 6.30% and a stop loss of 6.38%

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer

.jpg)

.jpg)