Buy Ashok Leyland Ltd For Target Rs. 161 By Choice Broking Ltd

Robust Exports, New Launches Propel Growth

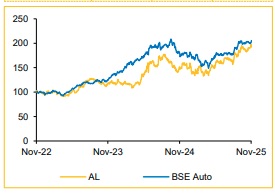

Expanding Market Presence with Strong Product Momentum: AL delivered another quarter of resilient performance, consolidating its leadership in the domestic MHCV and bus segments while strengthening its foothold in LCVs and exports. MHCV market share stood firm at 31% in H1FY26 (up 50 bps YoY), while LCV share improved to 13.2%, outpacing industry growth. Export volumes surged 45% YoY in Q2FY26, supported by strong traction across GCC, Africa and SAARC markets.

The company’s focus on premium product launches continues to enhance its competitive positioning. Upcoming 320HP and 360HP heavy-duty trucks, featuring advanced six-cylinder engines with 20–30% higher torque, are expected to drive margin-accretive growth in mining and construction segments.

In the LCV portfolio, the success of the ‘Saathi’ model and the planned launch of a bi-fuel (CNG/petrol or CNG/diesel) variant in the next two quarters would strengthen AL’s addressable market in urban logistics. Additionally, its bus capacity expansion, from 12,000 to over 20,000 units after ramp-up at its AP and Lucknow plants, will support rising domestic and export demand.

We expect AL’s diversified portfolio, focus on premiumisation and improving export mix to drive sustained revenue and margin growth. With a revival in fleet replacement demand, infrastructure momentum and an expanding alternative fuel lineup, the company is well-positioned to deliver profitable, long-term growth in FY26E and beyond.

View and Valuation: We revise our FY26/27E EPS estimate upwards by 2.2%/2.9%. We value AL’s core business at 20x (unchanged) on the average FY27/28E EPS and arrive at a value of INR 142. We assign a value of INR 15 to HLFL and INR 4 to Switch Mobility (as detailed in Exhibit 1), leading to a revised target price of INR 161. We maintain our BUY rating on the stock.

Q2FY26, Revenue/EBITDA largely in line, while earnings beat our estimate

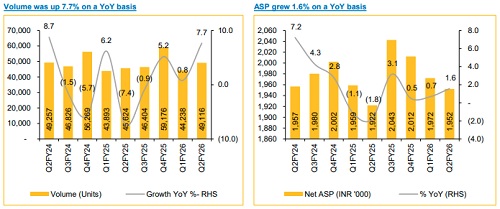

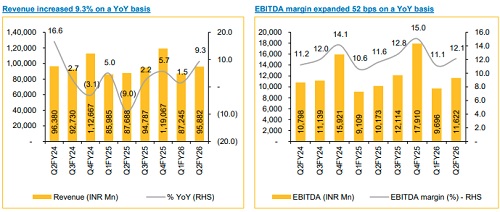

* Revenue was up 9.3% YoY to INR 95,882 Mn (vs CIE est. at INR 97,834 Mn), led by 7.7% YoY growth in volume and 1.6% YoY growth in ASP.

* EBITDA was up 14.2% YoY and up 19.9% QoQ to INR 11,622 Mn (vs CIE est. at INR 11,642 Mn). EBITDA margin was up 51 bps YoY and up 111 bps QoQ to 12.1% (vs CIE est. at 11.9%).

* APAT was up 24.3% YoY and up 36.6% QoQ to INR 8,111 Mn (vs CIE est. at INR 7,400 Mn).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131