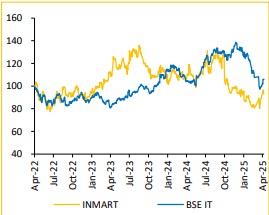

Add Indiamart Intermesh Ltd. For Target Rs.2,475 - Choice Broking Ltd

Revenue & EBIT marginally below estimates, PAT beats expectations even after excluding one-time exceptional gain

• Revenue for Q4FY25 came at INR 3.5Bn, up 12.8% YoY and 0.2% QoQ (vs consensus est. at INR 3.6Bn).

• EBIT for Q4FY25 came at INR 1.2Bn, up 61.3% YoY but down 6.1% QoQ (vs consensus est. at INR 1.2Bn). EBITDA margin was up 1033bps YoY but down 231bps QoQ to 34.4% (vs Consensus est. at 34.8%).

• PAT for Q4FY25 stood at INR 1.8Bn, up 81.3% YoY and 49.3% QoQ (vs consensus est. at INR 1.2Bn).

Revenue growth driven by price hikes on Gold & Platinum plans:

Annualized revenue per paying supplier (ARPU) reported strong growth of 11% YoY to INR62,000. This is partly due to increasing contribution from top 10% customers, mainly platinum. Key drivers include annual price hikes (10%) on Gold & Platinum plans, a variable pricing model for Platinum clients, & operational changes enhancing lead quality. We expect these strategies to collectively fuel sustained ARPU growth in the high-value customer segment.

Elevated churn in silver category remains concern for growth:

INMART faces ongoing challenges in Silver customer tier due to high churn, especially among firstyear users, with monthly estimated churn rate of 6–7% which has not yet met. Net supplier additions remained under 2,000 for 7 th consecutive quarter. Despite recent efforts to refine product-market fit & attract higher-quality customers, results are not yet evident. No price hikes have occurred in this tier, however, we expect reducing churn as essential to boost customer growth & balancing it with ARPU gains.

ARPU-driven collections growth despite 0% customer addition:

Management indicated that collections growth has normalized to around 9%-10% after a brief dip in Q2FY25. A key point emphasized is that this collections growth is currently almost entirely coming from ARPU, with customer addition growth being near 0%. While slowdown in collections growth is linked to high churn & low net additions, the management refuses to assume that this 8%-10% growth is new normal & is working towards accelerating growth again. We expect outlook for collections in the immediate term to continue around the 10%, primarily driven by ARPU, until improvements in customer growth are achieved.

EBITDA margin at 40% in Q4, normalization expected with investments & growth initiatives:

EBITDA margins are currently elevated at 40% for Q4FY25 & 39% for FY25. Consolidated margins were slightly lower at 37% & 38%, respectively. These high margins are driven by lower customer acquisition costs and operating leverage due to subdued net customer additions. Management expects margins to remain at 38–40% while focus remains on churn rather than growth. However, as strategic priorities shift toward expanding the customer base and ARPU, margins are expected to normalize to a sustainable 33–35%, driven by increased investments in marketing, manpower, & growth initiatives.

View and Valuation:

INMART's performance is characterized by reliance on ARPU-led growth & efforts to address foundational customer acquisition challenges. Although revenue growth has moderated, mainly due to lower churn rates among Gold & Platinum subscribers, the silver tier is yet to perform despite the ongoing efforts. EBITDA margins remained elevated & expected to normalize in upcoming quarters. We expect Revenue/ EBITDA/ PAT to grow at a CAGR of 11.0%/ 10.7%/ 6.6% over FY25-FY27E & revise our rating to ADD with an upward revised target price of INR2,475 implying a PE of 24x (maintained) on FY27E EPS of INR103.2.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131