Buy Godrej Properties Ltd for the Target Rs. 2,843 by Motilal Oswal Financial Services Ltd

Strong presales offset by soft collections and revenue hit from completions

Achieves 81% of annual BD guidance

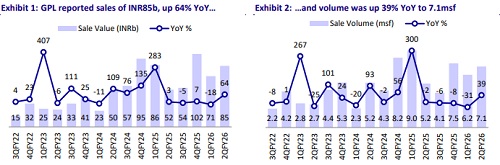

* Godrej Properties’ (GPL) pre-sales volume for 2QFY26 was up 39% YoY/16% QoQ at 7.1msf (31% above estimates). In 1HFY26, volumes stood at 13msf, down 6% YoY.

* In 2QFY26, pre-sales value stood at INR85b (+64% YoY/+20% QoQ, 42% above estimates). In 1HFY26, it stood at INR156b, up 13% YoY. About 48% of FY26 presales guidance is achieved in 1H.

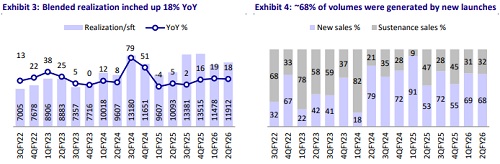

* Realization grew 18% YoY/4% QoQ to INR11,912/sq. ft. (8% above estimate). In 1HFY26, realization grew 20% YoY to INR11,711/sq. ft.

* 2Q pre-sales were driven by 12 new project/phase launches during the quarter (GDV of INR101b), which together accounted for a booking value of INR55b (65% of total reported bookings in 2QFY26). In 1HFY26, GPL launched projects worth GDV of INR186b.

* GPL sold 4,522 units in 2Q and 8,753 units in 1H.

* Deliveries stood at 2.2msf in 2Q and 3msf in 1H.

* Gross collections rose 5% YoY/10% QoQ to INR46b (8% below estimates), whereas OCF (pre-interest and tax) was down 35% YoY at INR11.9b. The company spent INR16.3b on new land investments and approvals. This led to a cash deficit of INR9.2b and increased the net debt to INR56b, or 0.3x of equity (vs. INR46b or 0.26x of equity as of 1QFY26). In 1HFY26, collections were up 12% YoY at INR87b, whereas OCF (pre-interest and tax) was down 24% YoY at INR21.4b. The company spent INR36.5b on new land investments and approvals. This led to a cash deficit of INR22.9b in 1H. The company foresees a meaningful increase in collections in 4QFY26.

* GPL added four new projects in 2QFY26 with a potential saleable area of 5.82msf and an estimated GDV of INR49b. In 1HFY26, GPL added nine new projects with total area of 15.06msf and GDV of INR163b, achieving 81% of its annual guided BD in 1H.

* Overall, 0.45msf was leased in 2QFY26 across three assets.

* P&L performance: GPL reported revenue of INR7.4b, -32% YoY/+70% QoQ (34% below our estimates), due to the absence of material completions during the quarter. In 1HFY26, revenue was INR11.7b, down 36% YoY.

* GPL reported EBITDA loss of INR5.1b vs. a profit of INR319m YoY. In 1HFY26, EBITDA loss stood at INR7.6b vs. a loss of INR931m YoY.

* Other income increased by 4x YoY/2% QoQ, driven by fair value gains from the acquisition of one of its JVs. As a result, PAT was up 21% YoY and down 33% QoQ at INR4b (23% below estimate), with a profit margin of 54%. In 1HFY26, other income increased by 97% YoY to INR24b, driven by fair value gains from the acquisition of four of its JVs, resulting in PAT of INR10b (up 17% YoY) with PAT margins at 85%.

Valuation and view

* GPL completed FY25 with a strong performance across key operational parameters of pre-sales and cash flows. With a strong launch pipeline, the company remains on track to achieve its operational goals. Thus, we keep our FY26/FY27 pre-sales estimates unchanged.

* While GPL has sustained gross margin at a healthy level of 35-40% for recognized projects in P&L, the higher scale of operations has led to a proportionately steeper increase in overhead, leading to subdued operating profits. We expect the sales booked over the past two years, characterized by a better margin profile and outright ownership, to be recognized after FY26/FY27, which will allay investor concerns.

* We believe GPL will continue to surprise on growth, cash flows, and margins, given its strong pipeline and healthy realizations, which have been key concerns for investors. We reiterate our BUY rating with a TP of INR2,843, implying a 30% potential upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412