Buy Galaxy Surfactants Ltd for the Target Rs. 2,570 by Motilal Oswal Financial Services Ltd

Macro headwinds hurt volume growth

Earnings below our estimate

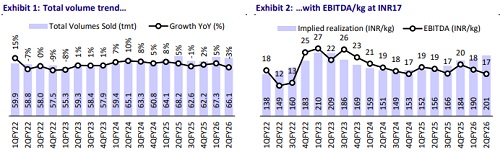

* Galaxy Surfactants (GALSURF) delivered a weak quarter, with EBITDA declining 13% YoY. EBITDA/kg stood at ~INR17, down 11% YoY in 2QFY26, primarily due to global tariff headwinds, reformulation within the performance segment, and lower domestic volumes following GST-driven inventory adjustments.

* The overall volumes remained flat YoY and QoQ, impacted by short-term disruptions in both the domestic and North American markets; however, this softness was partly offset by strong double-digit growth in Latin America and the Asia-Pacific region.

* Factoring in the weak 2Q performance and the challenging macro environment, we cut our FY26/FY27/FY28E earnings for GALSURF by 11%/11%/9%. We reiterate our BUY rating with a TP of INR2,570 (based on 27x FY27E EPS).

Revenue momentum healthy, while margin pressure drags earnings

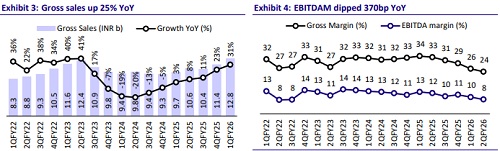

* Consolidated revenue grew 25% YoY to INR13.3b (est. INR12.5), primarily led by higher realizations, while overall volumes remained flat YoY.

* Revenue from India/AMET/Rest of World (ROW) grew 40%/14%/15% YoY to INR6b/INR2.8b/INR4.5b, while revenue from local and niche/MNC players grew 41%/20% YoY to INR5.8b/INR6.4b. However, revenue from regional players declined 9% YoY to INR1.1b.

* The revenue contribution of Performance Surfactants now stands at 63% compared with 61% in 2QFY25.

* GALSURF’s EBITDA margin contracted 370bp YoY to 8.3%, hurt by gross margin contraction of 850bp YoY to 24.5%. Employee costs as % of sales stood at 6% (vs. 7% in 2QFY25), while other expenses stood at 10% (vs. 14% in 2QFY25).

* The company’s EBITDA declined 13% YoY to INR1.1b (est. INR1.3b), and adj. PAT dipped 22% YoY to INR665m (est. INR824m).

* In 1HFY26, GALSURF’s revenue grew 28% YoY to INR26b, while EBITDA/Adj. PAT declined 7%/11% to INR2.3b/INR1.5b.

* Gross debt was INR1.9b as of Sept’25 vs INR1.4b as of Mar’25. Further, GALSURF generated a CFO of INR1.7b as of Sep’25 vs. a CFO of INR2.4b in Sep’24.

Key highlights from the management commentary

* Guidance: The company expects 3Q performance to remain similar to 2Q and maintains its confidence in medium-term consumption growth driven by GST reforms despite temporary softness from inventory adjustments and reformulations.

* India: The domestic performance witnessed short-term challenges, with flat volumes both YoY and QoQ. The GST rate cut on FMCG products led major players to recalibrate inventories, while elevated feedstock costs prompted some customers to reformulate products, affecting the performance segment volumes. Strong traction from Tier 2 customers helped offset weakness among Tier 1 accounts.

* US tariffs: North America faced margin pressure as tariffs affected the Specialty Care segment, causing delays in US projects and launches. Customers, too, are dissatisfied with the recent tariffs being imposed, as they want to diversify their vendor base and are looking forward to resuming business with the company.

Valuation and view

* We expect the short-term challenges to subside, led by the GST reforms to unlock the medium-term consumption upside in the domestic market.

* GALSURF’s long-term growth will be driven by 1) the company’s sustained focus on R&D, 2) improving domestic demand, 3) better raw material availability, and 4) enhancing and expanding global operations.

* We expect a revenue/EBITDA/adj. PAT CAGR of 12%/7%/8% along with a volume CAGR of 5% over FY25-28.

* Factoring in the weak 2Q performance and the challenging macro environment, we cut our FY26/FY27/FY28E earnings for GALSURF by 11%/11%/9%. We reiterate our BUY rating with a TP of INR2,570 (based on 27x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412