Sell GBPINR Jan @ 122 SL 122.3 TGT 121.7-121.5 - Kedia Advisory

USDINR

SELL USDINR JAN @ 90.1 SL 90.3 TGT 89.9-89.7.

Observations

USDINR trading range for the day is 89.76-90.52.

Rupee gained snapping a three-day slide as index-rebalancing inflows and trimmed dollar longs lifted sentiment.

India is poised for a significant economic year in 2025, with real GDP expanding at an 8.2% rate in Q2 FY25-26, a six-quarter high.

Dollar/rupee forward premiums eased again, with the one-year implied interest rate down about 10 basis points to 2.71%.

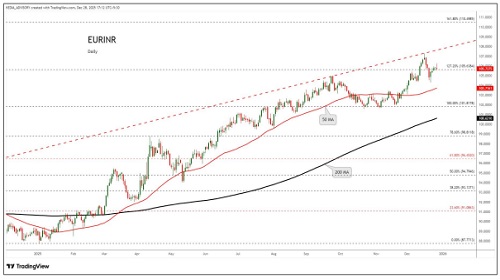

EURINR

SELL EURINR JAN @ 106.2 SL 106.5 TGT 105.9-105.6.

Observations

EURINR trading range for the day is 105.83-106.59.

Euro dropped as investors continue to weigh the prospects for additional Federal Reserve policy easing in 2026

Euro zone business activity growth slowed more than expected at the end of 2025 as a contraction in manufacturing deepened.

Euro zone consumer confidence fell by 0.4 points in December from the November number.

GBPINR

SELL GBPINR JAN @ 122 SL 122.3 TGT 121.7-121.5.

Observations

GBPINR trading range for the day is 121.35-122.13.

GBP dropped as investors expect the BoE to follow a moderate monetary easing cycle next year.

BoE cut interest rates after a narrow vote by policymakers, but it signalled that the already gradual pace of lowering borrowing costs might slow further.

Manufacturing activity data due on Friday will give the next indication of the state of Britain's economy.

JPYINR

SELL JPYINR JAN @ 57.85 SL 58 TGT 57.65-57.45.

Observations

JPYINR trading range for the day is 57.68-58.

JPY steadied as investors weighed the country’s expansive fiscal policy.

The cabinet recently approved PM Takaichi’s record-setting 122.3 trillion yen budget, aiming to balance aggressive fiscal spending.

On the monetary policy front, markets are watching July for the next rate hike, though an earlier move is possible if the yen weakens further.