Buy Allied Digital Services Ltd For Target Rs. 210 By Choice Broking Ltd

Order Pipeline Remains Healthy

ALDS Maintains Growth Momentum in Q2FY26

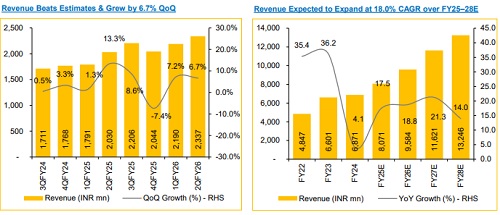

In Q2FY26, ALDS reported revenue of INR 2,337Mn, up 6.7% QoQ and 15.1% YoY. Broad-based growth was driven by Services (76% of revenue), led by infrastructure, cybersecurity, and digital workplace demand. Solutions grew via smart city projects, while Enterprise rose 18.1% YoY and India business sustained double-digit growth. We believe growth momentum remains robust, underpinned by a well-diversified client base and global execution capabilities. Improving macros and accelerating digital adoption should further aid deal conversions and pricing, particularly in enterprise and government transformation projects.

View and Valuation: ALDS is well-positioned for sustained growth, backed by strong order visibility, healthy enterprise demand, and management’s INR 10Bn annual revenue target over the next 4–5 quarters. Execution on large enterprise and government mandates, AI-driven automation, a broader services mix, and partner expansion should support margin normalisation toward 12–13%. Despite near-term cost pressures, robust deal momentum and improving operating leverage underpin steady earnings growth. We maintain our P/E multiple at 15x on FY27–28E average EPS to arrive at a target price of INR 210, reiterating our BUY rating with a potential re-rating as execution scales and earnings quality strengthens.

Q2FY26 Performance Outperforms Estimates

* Revenue for Q2FY26 came at INR 2,337 Mn up 6.7% QoQ & 15.1% YoY(vs CIE est. at INR 2,255 Mn).

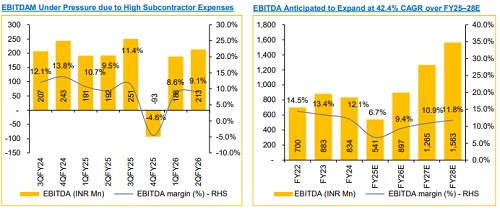

* EBITDA for Q2FY26 came at INR 213 Mn, up 13.2% QoQ and 11.0% YoY (vs CIE est. at INR 203 Mn). EBITDA margin stood at 9.1% vs 8.6% in Q1FY26, up 53bps QoQ (vs CIE est. at 9.0%).

* PAT for Q2FY26 stood at INR 154 Mn, up 6.7% QoQ and 32.8% YoY (vs CIE est. at INR 112 Mn).

Revenue Guidance Intact; Margins to Recover Mid-Term

Management reaffirmed its INR 10Bn annual revenue run-rate target over the next 4–5 quarters, with a INR 2.5 Bn quarterly run-rate expected by Q4FY26, supported by a strong order book. Margins are likely to remain under pressure in the near term, while the medium-term EBITDAM target of 12–13% remains unchanged. We expect recovery to be driven by AI-led automation, a higher services mix, and contract ramp-ups. Expansion of the direct sales engine and partner network is also expected to support scale and strengthen margin resilience.

Strong Global Deal Wins Signal Sustained Growth

During Q2FY26, ALDS secured new and renewal orders exceeding INR 6.98Bn, driven primarily by a landmark INR 4,200Mn multi-year managed services deal from a leading European multinational Pharmaceutical and Healthcare company. Other order wins include multi-year managed-services contracts from European and North American clients (apparel retail, and industrial automation), alongside continued traction in smart city and public surveillance projects in India. Overall, with improving macros, we expect strong growth in deal conversions with better pricing, particularly in enterprise business. While smart city project wins remain contingent on favorable bid outcomes.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131