Buy Ajanta Pharma Ltd for the Target Rs. 3,000 by Motilal Oswal Financial Services Ltd

In-line 2Q; growth led by DF/US generics

Efforts on track to sustain industry outperformance in branded generics

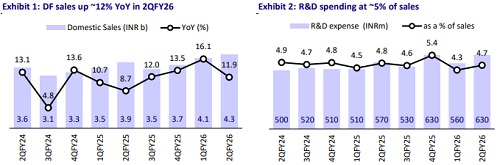

* Ajanta Pharma (AJP)’s 2QFY26 revenue was slightly above our expectation (3.5% beat). EBITDA and PAT were largely in line and grew at a lower rate compared to revenue growth for the quarter. Product mix across geographies and higher opex to enhance traction in newer therapies in the domestic formulation (DF) segment kept EBITDA/PAT growth under check.

* AJP is outperforming the industry in its core therapies (ophthalmology, dermatology, and pain therapies) within the DF segment. Additionally, it is improving traction in newer therapies like gynecology as well as nephrology.

* The company is deepening its presence through MRs in addition to a healthy pipeline of launches in branded generics (Asia/Africa).

* AJP delivered its third consecutive quarter of strong YoY growth in US generics, backed by launches and market share gains in existing products.

* We broadly retain our FY26/FY27/FY28 estimates. We expect 14% earnings CAGR over FY25-28, led by consistent industry-beating growth in branded generics markets of India/Asia/Africa and healthy traction in US generics.

* We value AJP at 30x 12M forward earnings to arrive at our TP of INR3,000. Considering superior execution across key markets supported by product launches as well as strengthening the field force, we expect AJP to deliver sustained growth over the next 3-5 years. Reiterate BUY.

Product mix drags profitability both YoY and QoQ

* AJP’s 2QFY26 revenue grew 14% YoY to INR13.5b (our est: INR13.0b), led by growth in all its key business areas.

* India sales rose 12% YoY to INR4.3b (32% of sales). The US generic sales grew 48% YoY to INR3.4b (26% of sales). Branded generics Asia sales rose 5% YoY to INR3.1b (23% of sales).

* The branded generic sales in Africa grew 4% YoY to INR2.2b (17% of sales). Africa Institutional sales declined 25% to INR320m (2% of sales).

* Gross margin contracted 130bp YoY at 76.6%.

* EBITDA margin also contracted ~120bp YoY to 27% (our est. of 28%), majorly due to contraction in gross margin.

* EBITDA grew 9.5% YoY to INR3.7b (our est. INR3.7b).

* Adjusting for the Net Forex loss impact of INR13m, Adj. PAT grew by 10.9% YoY to INR2.6b (our est. INR2.6b).

Highlights from the management commentary

* Two ANDAs were filed in 1HFY26. AJP received approvals for two ANDAs and launched three ANDAs in 1HFY26.

* AJP intends to file 10-12 ANDAs in FY26.

* AJP remains confident in delivering low-teens YoY growth in the Asia branded generics segment in FY26.

* AJP expects to sustain the growth momentum in the US generics segment in FY26 and can grow at high teens in FY27 as well.

* It guided a 78% (+-1%) gross margin and 27% (+-1%) EBITDA margin for FY26.

* A calibrated approach towards first-to-market launches may drive fewer such launches in the DF segment. Having said this, AJP remains confident to outperform the DF segment going forward as well. AJP is witnessing improved traction in newer therapies such as gynaecology/nephrology, and progress is as per expectation.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412