Neutral Craftsman Automation Ltd for the Target Rs. 6,542 by Motilal Oswal Financial Services Ltd

Earnings beat largely driven by aluminum segment

Maintains growth guidance for FY26

* Craftsman’s 2QFY26 consol PAT of INR912m was ahead of our estimate of INR863m, aided by better-than-expected revenue growth, especially in the aluminum segment.

* Aluminum business should remain a key growth driver going forward on the back of a ramp-up of its alloy wheel facilities in Bhiwadi and Hosur, steady order visibility from both domestic and export customers, and benefits of restructuring of Sunbeam to be visible from FY27E. However, powertrain margins are likely to remain under pressure at least in the near term as Craftsman looks to develop products for data center applications, which are significantly high-gestation projects (3-4 years for SOP). After the recent run-up in the stock, most of the positives seem factored in at 42.7x FY26E and at 29.1x FY27E consolidated EPS. We maintain Neutral with a TP of INR6,542 (valued at 24x Sep’27E EPS).

Earnings beat driven by strong performance in aluminum segment

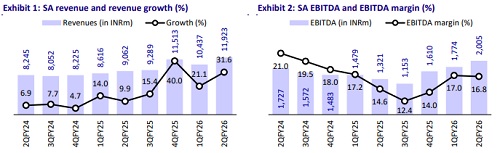

* Craftsman’s 2QFY26 results included the full impact of the recently acquired subsidiaries. Hence, YoY growth rates are not comparable. Consolidated revenue grew 65% YoY to INR20b (above our est. of INR18b). Revenue grew 12.2% QoQ and was supported by the aluminum segment’s ramp-up.

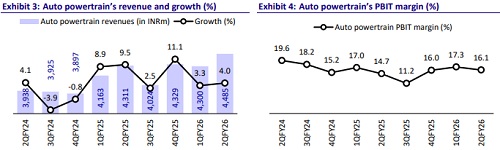

* Among segments, aluminum segment margins improved 160bp QoQ (down 230bp YoY) to 11.7%, ahead of our estimate of 10.2%. On the other hand, powertrain segment margins declined 60bp QoQ to 14.6%, below our estimate of 15.2%. Industrial segment margin also contracted 80bp QoQ to 1.4%, below our estimate of 2.2%.

* Gross margin rose 90bp YoY to 45.3%.

* Consolidated margins came largely in line with our estimate at 15.1%. However, given the better-than-expected revenue growth, EBITDA grew 14% to INR3b even on QoQ basis and was 9% ahead of our estimate of INR2.8b.

* Craftsman reported an exceptional loss of INR5m due to relocation-related costs for the Gurugram facility of Sunbeam.

* Overall, PAT grew 20% QoQ (+48% YoY) to INR912m.

* On a consol basis, Craftsman’s cash outflow stood at INR1.3b largely due to highly adverse working capital. Further, it had invested about INR5.7b in capex for 1H. Thus, free cash outflow stood at INR7b as of Sep’25.

* 1HFY26 revenue/EBITDA/PAT grew 60%/45%/38% to INR37.9b/INR5.7b/ INR1.6b. In 2H, we expect Craftsman’s revenue/EBITDA/PAT to grow 24%/ 50%/97% to INR41.2b/INR6.6b/INR2.2b

Highlights from the management interaction

* Management expects consolidated revenue to continue to grow in double digits over the next several years. 2HFY26 performance is likely to exceed 1H performance as the new aluminum and alloy-wheel facilities ramp up and Sunbeam’s operations stabilize.

* The Kothavadi plant is currently in phase 1 and is operational for engineering components. Management has reiterated a long-term revenue guidance of USD100m from the stationary engines business by FY30. Half of the order book (USD50m) has already been secured, and the remaining is under advanced stages of negotiations. Commercial revenue is expected to flow in from FY29 as these are long-gestation projects.

* Management has indicated that improved margins for the aluminum business are sustainable for the foreseeable future as the setup costs for the Bhiwadi plant have normalized, and the Hosur facility is currently in the ramp-up phase. Further, sharing of infrastructure for Bhiwadi plant with Sunbeam is also helping drive better margins.

* Sunbeam reported revenue of INR3.3b in 2QFY26. EBITDA margins currently stand at 6%. While revenue is likely to remain stable in FY27, management will now focus on improving efficiencies in this business and hence expects EBITDA margin to improve to double digits by FY27.

* FY26 capex is guided at INR10b for standalone business and INR2.8b for DR Axion. Capex for Sunbeam is expected to be negligible.

* Management expects India to become a central manufacturing hub for CV powertrains and stationary engines in the coming years.

* Generators manufactured for data centers are highly tech intensive as they may shut down even with small fluctuation in power. Globally, only 8-9 companies are present in this segment, of which the top four command almost 70-80% market share. Craftsman is currently working with three of these top four global companies.

Valuation and view

* Aluminum business is likely to be a key growth driver going forward on the back of the ramp-up of its alloy wheel facilities in Bhiwadi and Hosur, steady order visibility from both domestic and export customers, and benefits of the Sunbeam restructuring to be visible from FY27E. However, powertrain margins are likely to remain under pressure at least in the near term as Craftsman looks to develop products for data center applications, which are significantly highgestation projects (3-4 years for SOP). After the recent run-up in the stock, most of the positives seem factored in at 42.7x FY26E and at 29.1x FY27E consolidated EPS. We maintain Neutral with a TP of INR6,542 (valued at 24x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412