Buy APL Apollo Tubes Ltd for the Target Rs. 1,920 by Motilal Oswal Financial Services Ltd

Volume-driven growth; margins to improve further

Earnings above our estimates

* APL Apollo Tubes (APAT) reported a strong quarter led by healthy volume growth (25% YoY), while the margin recovered (EBITDA/MT improved 18% YoY/17% QoQ to INR4,864) amid weaker macroeconomic conditions on the back of a brand premium (~5% higher realization than the nearest competitor in general structures) and better VAP mix.

* We expect the growth momentum to continue, led by demand recovery and margin improvement supported by capacity expansion across geographies (6.8MMT by FY28 vs. 4.5MMT in FY25). The management guided a 20% volume CAGR over the next two years with an EBITDA/MT expectation of INR5,000 in FY26, followed by further improvement.

* We reiterate our FY26E/FY27E earnings and value the stock at 34x FY27 EPS to arrive at our TP of INR1,920. Reiterate BUY.

Margin recovery due to improving HRC prices and better economies of scale

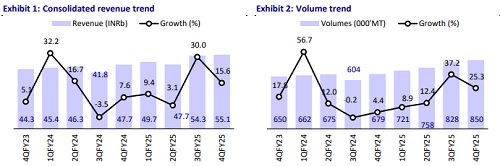

* Consolidated revenue grew 16% YoY (flat QoQ) to INR55b (in line), fueled by volume growth (up 25% YoY/3% QoQ to ~850KMT), which was partially offset by a decline in realization (down 8% YoY/1% QoQ to INR64,773). The VAP mix stood at 58% in 4QFY25 vs. 60%/56% in 4QFY24/3QFY25.

* Gross profit/MT was up 2% YoY/3% QoQ to INR9,550. EBITDA/MT rose 18% YoY/17% QoQ to INR4,864 (est. INR4,474). EBITDA grew 48% YoY/ 20% QoQ to INR4.1b (est. INR3.9b).

* Adj. PAT jumped 72% YoY/35% QoQ to INR2.9b (est. INR2.4b), led by higher other income (+ 88% YoY) and lower taxes(ETR of 18.3% vs. 23% in 4QFY24).

* In FY25, APAT’s revenue/Adj. PAT grew 14%/3% YoY to INR206.9b/ INR7.5b, while EBITDA remained flat at INR11.9b. The EBITDA/MT declined 17% to INR3,797. Volume grew 21% to 3,157,997MT.

Highlights from the management commentary

* Operational highlights: APAT surpassed 3.1MT in sales volume in FY25 and became the world’s largest downstream player outside China. Additionally, the company has consistently maintained a strong cash conversion, with OCF/EBITDA exceeding 90% and reaching 100% in FY25.

* Margin story: APAT aims to maintain its brand premium for APL Apollo to support healthy margins, while targeting a reduction in employee cost per ton from ~INR1,000 in FY25 to ~INR800/INR600 in FY26/FY27 through increased automation. Additionally, an increase in the VAP mix, such as commissioning a 1000x1000 pipe plant next month with an expected volume of ~50KMT (at EBITDA/MT of ~INR10,000), will further boost its profitability.

* Expansion plans: The company plans to expand via four key levers: expansions in key markets (East India, South India, and Dubai), new product segments, exports, and sustaining its brand premium. APAT will incur a capex of INR15b over the next three years to raise capacity from 4.5MMT to 6.8MMT by FY28.

Valuation and view

* We expect sustained volume growth for APAT, led by capacity expansion in key markets, new product additions, and higher exports. APAT’s margin improvement would follow, driven by cost optimization, increased automation, and a rising mix of value-added products, supporting steady growth in EBITDA/MT.

* We expect APAT to clock 19%/27%/43% CAGR in revenue/EBITDA/PAT over FY25-27E. We value the stock at 34x FY27 EPS to arrive at a TP of INR1,920. Reiterate BUY

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)