Buy Ahluwalia Contracts India Ltd For the Target Rs.860 By the Axis securites

Recommendation Rationale

Robust order book: The company has an order book of Rs 16,258 Cr (as of 31st Dec'24) and a YTD order inflow of Rs 7,794 Cr. The breakup of this order book is as follows: Hospital – 14% (Rs 2,279 Cr), Commercial – 17.4% (Rs 2,832 Cr), Institutional – 7.6% (Rs 1,234 Cr), Residential – 30.8% (Rs 5,002 Cr), Infrastructure – 29.3% (Rs 4,763 Cr), and Hotel – 0.9% (Rs 149 Cr). The robust order book provides revenue visibility for the next 3- 4 years. The bidding pipeline also remains robust. The company is, therefore, expected to achieve revenue growth of 15% CAGR over FY24-FY26E and is likely to post improved margins with better execution.

NGT Ban has impacted the execution: In Oct’24, the NGT ban in Delhi-NCR affected project execution, impacting 33% of the company’s order book. As a result, management has revised its revenue growth guidance to 10%, with EBITDA margins now expected to be in the range of 8.5-9%, compared to the previously anticipated double-digit margins for FY25. Accordingly, we are adjusting our revenue estimates downward for FY25. However, with the expected easing of the ban, a revenue pickup is anticipated in FY26.

Robust financial position: The company exhibits a strong financial position, reflected in its net debt-free status, robust cash/bank balance, and high return ratios. Additionally, the government’s increased focus on developing institutions, healthcare infrastructure, and other emerging opportunities in both public and private sectors is expected to sustain the company’s robust order inflow moving forward.

Sector Outlook: Positive

Company Outlook & Guidance: For FY25, management has revised their guidance for revenue growth to 10% and EBITDA margins to be 8.5-9%. For FY26, revenue growth of 15- 20% is expected with above 10% EBITDA margins

Current Valuation: 18x FY26E EPS (Earlier Valuation: 20x FY25 EPS)

Current TP: Rs 860/Share (Earlier TP: Rs 1,090/share)

Recommendation: We maintain our BUY rating on the stock.

Alternative BUY Ideas from our Sector Coverage: PSP Projects Ltd (TP- Rs 695/Share)

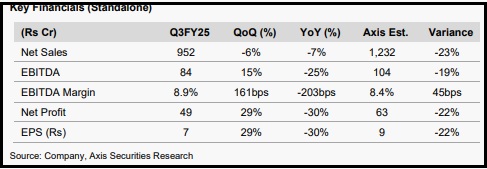

Financial Performance: Ahluwalia Contracts India Ltd. (ACIL) reported a weak set of Q3FY25 numbers. The company reported revenue of Rs 952 Cr (down 6% YoY) and EBITDA of Rs 84 Cr (down 25% YoY). It posted a PAT of Rs 49 Cr (down 22% YoY). EBITDA margins stood at 8.9% in Q3FY25 (Our Estimate: 8.4%) compared to 10.9% in Q3FY24.

Outlook Execution has slowed due to the NGT ban; however, the executable order book remains robust. With favourable attributes such as a strong and diversified order book, a healthy bidding pipeline, steady order inflows, an asset-light model, and emerging opportunities in the construction space, the company is expected to generate healthy free cash flows moving forward and deliver Revenue/EBITDA/Adj. PAT growth of 15%/17%/17% CAGR over FY24-FY26E.

Valuation & Recommendation The stock is currently trading at 15x FY26E EPS. We value the company at 18x FY26E EPS and maintain our BUY rating with a TP of Rs 860/share, implying an upside of 21% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633