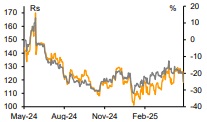

Reduce Union Bank of India Ltd For Target Rs. 120 By Emkay Global Financial Services Ltd

Growth and margins set to moderate

After a soft 3Q, Union Bank reported a ~10% beat on PAT at ~Rs50bn (vs the Emkay estimate of Rs45bn), owing to mainly higher treasury gains and lower tax in 4Q. Credit growth picked up as well, up 10% YoY/3.6% QoQ, while deposit growth was robust at 7% QoQ, with sharp seasonal acceleration in CA deposits. This led to lower CoF, which, combined with higher inter-bank money market operations, led to an 18-bps QoQ jump in NIM to 3.09%, defying peer trends. For FY26, the bank guides for slower credit growth in line with GDP growth. This, coupled with the swift policy rate cycle, could stress the bank’s margin in the near term. However, we expect the bank to still manage 0.9-1.1% RoA, aided by better treasury gains, NPA recovery, and lower LLP. We retain REDUCE on the stock with an unchanged TP of Rs120, valuing the bank at 0.7x FY27E ABV. Our preferred picks among PSBs are SBI and Indian Bank.

Healthy business growth and margins

Union Bank reported a healthy credit growth of 10% YoY/3.6%QoQ, driven by robust growth in the retail segment (~22% of the overall book), although this was partly offset by muted growth in the corporate segment and a sequential decline in the agri book. Deposit growth was also strong at 7% YoY and 7.7% QoQ, while the CASA ratio remained steady at ~33%, aided by a sharp 29% QoQ increase in CA. This led to lower CoF, which along with deployment of easy liquidity in the inter-bank money market, led to an 18bps QoQ uptick in NIMs to 3.1%. Although the management did not offer formal guidance, they intend to grow the loan book at a modest rate, in line with GDP growth, maintaining a 75:25 mix between RAM and corporate lending, and focus on managing margins at current levels.

Higher slippages, albeit the GNPA ratio continues to improve

Fresh slippages were slightly higher at Rs 25.7bn/1.2% of loans, due to higher slippages in the agri (owing to repeated restructuring) and MSME (owing to full automation of asset classification) segments. However, higher recoveries led to a 25bps QoQ decline in the GNPA ratio to 3.6%. NNPA ratio too improved by 19bps QoQ to 0.6%, on the back of 382bps QoQ improvement in specific PCR to 83%. The overall SMA book too eased further to Rs38bn/0.4% of loans vs Rs76bn/0.8% of loans in Q3. The management expects fresh slippages to moderate from here on, and asset quality to remain healthy.

We retain REDUCE

We expect the bank to still manage 0.9-1.1% RoA, aided by better treasury gains, NPA recovery, and lower LLP. Retain REDUCE on the stock with an unchanged TP of Rs120, valuing the bank at 0.7x FY27E ABV. Our preferred picks among PSBs are SBI and Indian Bank. Key risks: Emerging asset-quality risk in the SME space and growth moderation as macros deteriorate.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354