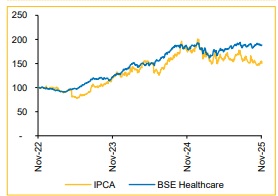

Add IPCA Laboratories Ltd For Target Rs. 1,410 By Choice Broking Ltd

Exports Rebound, Margin Improves

Exports and Unichem Recovery to Drive Growth, Margin Outlook Revised

IPCA’s overall revenue growth outlook remains unchanged. With expectations of high single- to low double-digit growth in FY26, we expect this to be supported by a recovery in the exports API business, positive contribution from Unichem and steady growth in formulations. Meanwhile, a healthier product mix, ongoing cost-control initiatives and operational turnaround at Unichem are expected to drive margin expansion. Management has accordingly revised its EBITDA margin guidance upwards by 100 bps to 21% for FY26. Reflecting this improved outlook, we have revised our estimates upward by 4.9%/3.3% for FY26E/FY27E. We continue to value the stock at 25x the average of FY27–28E EPS, arriving at a target price of INR 1,410 (Q1FY26: INR 1,350), and upgrade our rating to ADD.

Strong Sequential Recovery with Margin Expansion

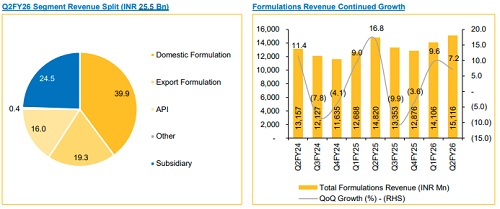

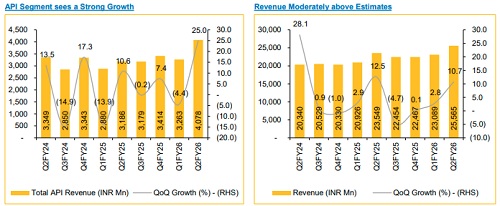

* Revenue grew 8.6% YoY / 10.7% QoQ to INR 25,565 Mn (vs. CIE estimate: INR 24,902 Mn).

* EBITDA grew 23.4% YoY / 30.9% QoQ to INR 5,449 Mn; margin expanded 257 bps YoY / 328 bps QoQ to 21.3% (vs. CIE estimate: 18.7%).

* APAT (adjusted for exceptional item of INR 583 Mn) increased 41.5% YoY / 39.2% QoQ to INR 3,247 Mn.

API Momentum Strong; Formulations Stabilising; FY26 Growth 8–12%

API segment delivered robust growth of 28% YoY, driven by new business wins from European customers and bulk orders in high-margin products. We expect Europe and LATAM to remain key growth contributors, with segment growth projected at ~12% in FY26E. Formulations, however, may witness near-term moderation as the company focuses on API-backed filings to strengthen longterm sustainability. Gradual improvement is expected from Q4FY26, supported by the scaling up of new launches in the US and synergy gains from the Unichem acquisition. In the domestic formulations market, we anticipate a favourable product mix shift towards chronic therapies and potential benefits from GST rate rationalisation. Overall, we project consolidated revenue growth in the high single to low double digits for FY26E.

Margin Expansion Sustained; Outlook Raised to 21% for FY26

EBITDA margin expanded by 257 bps YoY to 21.3%, reflecting strong operating performance. Management has revised its FY26 margin outlook upward by 100 bps to ~21%. We believe this will be supported by a favorable shift in product mix toward chronic therapies, a turnaround in the Unichem business, and the closure of the loss-making Ireland facility. These factors will sustain profitability momentum over the medium term.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131