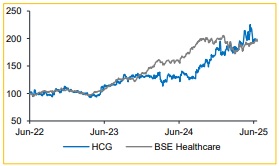

Add Healthcare Global Enterprises Ltd For Target Rs. 590 - Choice Broking Ltd

HCG Centres of Excellence, Bangalore

We visited HCG Centres of Excellence, Bangalore, and met with Mr. Ashutosh Kumar – VP – Strategic Planning & Corporate Development.

Management guidance: The management intends to strategically transition the facility portfolio towards a specialized oncology focus, shifting from a multi-specialty model, which will enhance the value proposition for international patients while strengthening presence in existing markets. Additionally, the company plans to divest its fertility business to streamline operations and concentrate on higher-margin, high-growth segments. The objective is to achieve a revenue growth target of 15%, with an EBITDA growth target of 18-20%.

Post-visit changes & Valuation: After the management meeting, we have revised our financial estimates for FY26 and FY27, reflecting a revenue growth target of 15% and EBITDA growth of 18-20%. As a result, we have updated our target price to INR 590 (up from INR 575), maintaining an EV/EBITDA multiple of 17x for FY27. Consequently, we have upgraded our rating to ADD (from REDUCE).

About the facility: HCG Centres of Excellence, Bangalore and founded in 1989, is one of India's leading specialty cancer care institutions, with a bed capacity exceeding 220. The facility commands a market share of 30-32% in Bangalore, offering a full spectrum of cancer care services, including screening, diagnosis, and treatment. It caters to all oncology subspecialties, such as surgical oncology, radiation therapy, pediatric oncology, and bone marrow transplants, among others, positioning itself as a comprehensive, multi-disciplinary cancer care provider.

Expansion Plan: In the next 3 years, ~900 beds will be added, including 200 currently unutilized and 600–700 to be developed through strategic investments.

* HCG has successfully capitalized 350 beds, with the remaining 550 beds requiring future capital expenditures. In Q1FY26, the company inaugurated its flagship 189-bed facility in Ahmedabad. Additionally, HCG plans to launch two new hospitals: one in North Bangalore (H2FY26) and an extension of its existing Centres of Excellence in Whitefield, aimed at expanding market reach and improving operational efficiency.

Growth in the Operating Metrics:

* ARPOB: The ARPOB is expected to grow by ~5% due to pricing adjustments, reaching INR 48,500 by FY27, up from INR 44,000 in FY25.

* Milann (Fertility Business): The business unit continues to underperform, and the company is actively considering a proposal to divest this segment by FY26.

* International Patient: This business unit contributes approximately 4% of total revenue, primarily from Bangalore, Mumbai, and Kolkata. It also operates a center in Africa, which addresses basic patient needs, while more complex surgeries are referred to India. The segment is marginaccretive, generating an EBITDA margin of around 24%.

* Payer Mix: The share of ESIC revenue is minimal, contributing only 1- 1.5% of total revenue, and has been completely discontinued. Additionally, the company is optimizing government channels that either offer poor payment terms or are low-paying.

* Robotics Surgery: Revenue from metro cities accounts for a larger share compared to non-metro cities, contributing 10-15% of revenue.

* Oncologist Network: Every Tuesday, a network of ~400 oncologists convenes to analyze complex cases, discuss potential treatment options, and collaborate to provide the best care for patients.

Risks to our investment case: The company faces increasing competition from multi-specialty hospitals expanding into oncology, a decline in the share of international patients, and a growing reliance on government business.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131