Gold and silver prices retreated from record highs on Monday as traders took profit after a record-breaking rally - HDFC Sescurities Ltd

GLOBAL MARKET ROUND UP

Gold and silver prices retreated from record highs on Monday as traders took profit after a record-breaking rally. Silver’s sharp reversal Monday came hours after soaring above $84 an ounce as surging Chinese investment demand pulled the metal higher. Premiums for spot silver in Shanghai rose above $8 an ounce over London prices, the biggest spread on record.

Spot gold fell as much as 4.5%, marking the biggest intraday drop since Oct. 21 and the second time this year the precious metal plunged that much in one day. Silver tumbled 9% in its biggest intraday decline since September 2020. Both metals posted a sharp retreat from fresh all-time highs that triggered signals that their rallies had run too fast, too soon. We expect that after yesterday's decline, bullion will now consolidate in the lower end of the range amid low liquidity due to the New Year's holiday.

Crude oil reversed Friday’s decline as US-led talks to end Russia’s war in Ukraine faced new complications and China vowed to support growth next year. New sticking points emerged on Monday when Russian President Vladimir Putin said Russia would revise its negotiating position due to a purported drone attack on one of his residences. Meanwhile, strength in Chinese crude demand is supportive for prices. China’s crude imports this month are set to increase by 10% m/m to a record 12.2 million bpd as it rebuilds its crude inventories.

Natural gas prices rose on Monday, supported by forecasts of colder temperatures in the U.S., which are expected to boost heating demand.

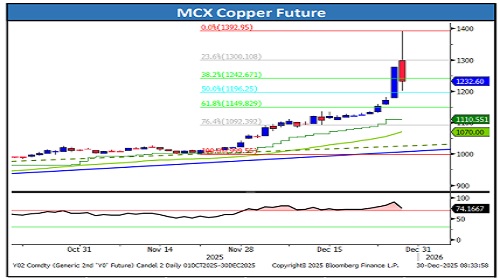

Copper saw an increase during a volatile trading session, with futures on the LME rising after the reopening following the Christmas holiday. This upswing continues a strong endof-year rally amid tightening global availability. The latest surge indicates an extraordinary year for copper, positioning it for its best performance since 2009.

Gold

* Trading Range: 133780 to 137300

* Intraday Trading Strategy: Sell Gold Mini Feb Fut at 136050-136075 SL 136900 Target 135050/134750

Silver

* Trading Range: 222480 to 239100

* Intraday Trading Strategy: Sell Silver Mini Feb Fut at 235575-235600 SL 238700 Target 230900/229750

Crude Oil

* Trading Range: 5165 to 5325

* Intraday Trading Strategy: Buy Crude Oil Jan Fut at 5225-5230 SL 5165 Target 5280/5315

Natural Gas

• Trading Range: 345 to 380

• Intraday Trading Strategy: Buy Natural Gas Jan Fut at 352-353 SL 344.80 Target 362/366

Copper

* Trading Range: 1200 to 1325

* Intraday Trading Strategy: Buy Copper Jan Fut at 1240-1242 SL 1227 Target 1255/1162.8

Zinc

* Trading Range: 301.50 to 315

* Intraday Trading Strategy: Buy Zinc Jan Fut at 305.50 SL 302.75 Target 309.50/312

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

.jpg)