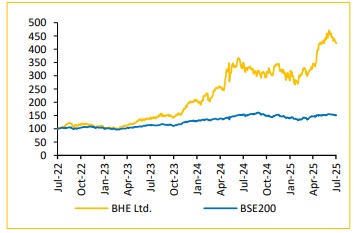

Add Bharat Electronics Ltd For Target Rs. 500 By Choice Broking Ltd

Multi-year visibility; INR 74,859 Cr order book 3.1x FY25 revenue

In our view, BHE is not just a proxy to India’s defence indigenisation story -- it is the nucleus of it. With a healthy order book of INR 74,859 Cr (~3.1x FY25 revenue), scalable execution model, strategic tech investments, and margin tailwinds, BHE offers a structural growth opportunity over the next 3– 5 years. The company has guided for FY26 order inflows of INR 27,000+ Cr (excluding QRSAM), which could rise to INR 30,000+ Cr if QRSAM is awarded by Q4FY26—further strengthening growth visibility.

We forecast a 19.3% revenue CAGR over FY25-28E and margin expansion of 140bps, driven by next-gen systems like QRSAM, Akash NG, and Akash Prime. The management has guided USD 120 Mn+ exports in FY26 to Europe, the Middle East, and Africa, signaling BHE’s growing relevance in global security. Investments in AI, drone warfare, and cybersecurity push BHE beyond traditional into future-tech domains.

In our view, BHE is a structural defence compounder with longevity, cash generation, and deep strategic moats -- well aligned with India’s multidecade defence capex supercycle.

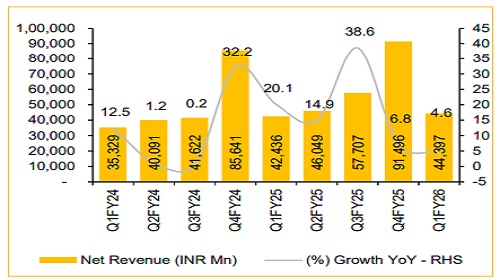

Decent performance with margin expansion

* Revenue for Q1FY26 up by 4.6% YoY & down by 51.5% QoQ at INR 44.4 Bn (vs CIE est. INR 50.5 Bn).

* EBIDTA for Q1FY26 up by 30.6% YoY and down by 56.0% QoQ at INR 12.4 Bn (vs CIE est. INR 11.5 Bn). The EBITDA Margin stood at 27.9%, improved by 555bps YoY (vs CIE est. 22.3%).

* PAT for Q1FY26 up by 23.0% YoY and down 54.7% QoQ at INR 9.6 Bn (vs CIE est. INR 9.1 Bn). The PAT Margin improved by 323bps YoY, reaching 21.6% (vs CIE est. 18.1%).

View & Valuation:

We maintain our positive stance on BHE, underpinned by its robust long-term growth visibility, supported by a healthy orderbook and strong order pipeline. The govt’s continued thrust on defence indigenization remains a key structural tailwind. We revise our estimates based on the average FY27/28E EPS and maintain our TP at INR 500, valuing the stock at 40x forward earnings. We reiterate our ‘BUY’ rating, reflecting confidence in BHE’s consistent execution and sustained growth potential.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131