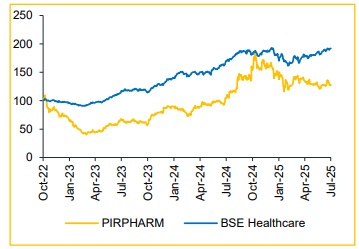

Reduse Piramal Pharma Ltd For Target Rs. 195 By Choice Broking Ltd

Near-Term Margin and Profitability Under Pressure

We believe PIRPHARM is likely to face headwinds at the EBITDA and PAT levels in FY26E, led by elevated operating costs from new facility scale-ups and product launches, along with higher tax rates. While management has reiterated its long-term growth guidance and revenue may see some traction, margin and profitability recovery will depend on the company’s ability to ramp up operations efficiently and manage its cost base. As a result, we revise our FY26E/FY27E EPS estimates downward by 46.0%/38.4%. We now value the company at 35x (vs. 40x earlier), based on the average of FY27E and FY28E EPS, to reflect near-term profitability headwinds, margin compression, and tax-related risks. This yields a revised target price of INR 195 (Q4FY25: INR 235), and we downgrade our rating to REDUCE.

Sharp Miss Across Metrics; Yet Another Loss-Making Q1

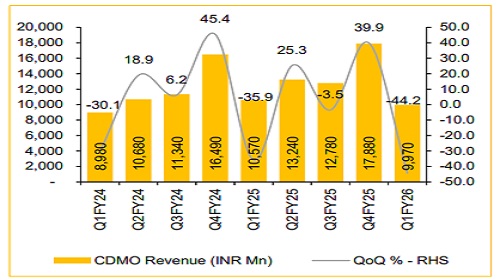

* Revenue declined 29.8% QoQ / remained flat YoY at INR 19.3 Bn (vs. consensus estimate: INR 20.5 Bn).

* EBITDA de-grew 47.8% YoY / 81.0% QoQ to INR 1.1 Bn; margins contracted 496 bps YoY / 1,485 bps QoQ to 5.5% (vs. consensus: 10.7%).

* Net loss stood at INR 817 Mn vs. a loss of INR 886 Mn YoY (vs. consensus estimate: INR 900 Mn). ? Exceptional income of INR 2.07 Bn was recorded against a claim reversal related to a legal settlement by a subsidiary.

Quarter Impacted by Seasonality; FY26E Growth Moderate

The company reported a weak quarterly performance, largely impacted by seasonal softness. While management has reiterated its long-term revenue guidance of USD 2 Bn by FY30E, we believe achieving this target will hinge on successful execution of its launch and expansion strategies. For the current fiscal, growth is expected to remain moderate likely in high single digits, driven by the CDMO order book and a recovery in institutional sales.

Inventory Destocking, High Tax to Weigh on Earnings

Margins came under significant pressure during the quarter, primarily due to ongoing inventory destocking. Management now expects EBITDA margins (including other income) to settle in the mid-teens range, implying a YoY contraction. The decline is driven by increased costs associated with scaling up new facilities and lower operating leverage. Profitability growth is also expected to remain muted, weighed down by ongoing tax-related issues and elevated tax rates, which are unlikely to normalize in the near term. While some relief may come from tax incentives related to R&D investments in the US, PAT growth is expected to be minimal.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131