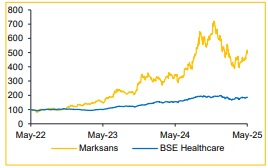

Buy Marksans Pharma Ltd For Target Rs. 315 - Choice Broking Ltd

Marksans Poised for Robust Growth and Margin Expansion

Marksans is well-positioned to deliver strong revenue growth and margin expansion over the coming years. The company has a healthy product pipeline across the North America and Europe markets. Additionally, the ongoing scale-up of its Teva facility is expected to drive operational leverage, enhancing margins as utilization improves. Management sees minimal impact from potential US tariffs, with retailers likely to pass on added costs to consumers.

We revise our FY27E estimates upward by 2.0%. We now expect Revenue/EBITDA/PAT to grow at a CAGR of 20%/22%/26% over FY24–27E. We maintain our PE multiple of 23x on FY27E EPS and revise our target price to INR 315 (from INR 310 in Q3FY25), reaffirming our BUY rating on the stock.

Strong Topline Growth Offset by Margin Pressure

* Revenue grew 26.5% YoY / 3.9% QoQ to INR 7.1 Bn (vs. consensus estimate: INR 7.0 Bn), driven by strong growth in North America and RoW markets.

* EBITDA increased 14.7% YoY but declined 9.3% QoQ to INR 1.3 Bn (vs. consensus: INR 1.4 Bn); margins contracted 182 bps YoY / 259 bps QoQ to 17.8% (vs. consensus: 19.8%).

* PAT rose 16.9% YoY but declined 13.6% QoQ to INR 908 Mn (vs. consensus estimate: INR 1.0 Bn).

On Track to Achieve INR 3,000 Cr Revenue Driven by Growth in North America and Europe:

The company remains on track to achieve its revenue target of INR 3,000 Cr in FY26, a growth of 14%+. This growth will be primarily driven by robust performance across geographies, particularly in North America and Europe, which together contributed approximately 86% of FY25 revenues. In North America, we believe the growth will be supported by 8–10 new product launches in FY26, along with market share gains in the existing portfolio. In the UK, the company secured 12 product approvals in FY25 and has filed for an additional 18, positioning it well for continued expansion. Furthermore, plans to acquire a marketing company in the UK are underway to strengthen its commercial presence in the region.

Teva Facility Scale-Up Set to Boost Margins by 134 bps:

The Teva facility remains a strategic pillar in the company’s growth roadmap, particularly in scaling up supplies to the US market. The company is targeting full capacity utilization by FY26 or early FY27. Management believes the facility could contribute up to INR 1,000 Cr to revenue (INR 300–350 Cr in FY25). With improving asset utilization, we expect operational leverage to support a recovery, projecting a 134 bps expansion in EBITDA margins in FY26E

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131