Sell Ramco Cements Ltd For Target Rs. 960 By Choice Institutional Equities

Sub-optimal Return Profile

We maintain our SELL rating on The Ramco Cements Ltd (TRCL). The stock trades at rich FY27E EV/EBITDA, EV/CE and PE multiples of 14.9x/2.2x/41.2x, respectively. At FY26E/27E/28E ROCE of 6.9%/8.8%/10.2% and ROE of 4.7%/6.9%/8.5%, TRCL’s ROCE/ROE do not cover its WACC & cost of equity at 11.6%/12.5% even under optimistic operational assumptions. In our view, TRCL’s capital structure is fully stretched with net debt at INR 44 Bn (FY25-end), implying 3.6x Net Debt/EBITDA, leaving no optionality to improve the return profile. TRCL would be unappealing to many sections of investors who may believe this level of debt for a cement company is excessive and makes PAT volatile.

Over FY25–28E, despite factoring in 1) Capacity increase of 5 Mnt, 2) Increasing green power share, 3) Volume CAGR of 7.0% and 4) Optimistic realisation assumptions, TRCL’s return metrics do not cover the cost of capital over the period.

We arrive at a 1-year forward TP of INR 960/share for TRCL. We value RAMCO on our EV/CE framework - we generously assign an EV/CE multiple of 1.9x/ 1.9x for FY27E/28E. Although TRCL’s ROCE is expected to expand from 4.5% in FY25 to 10.2% in FY28E, it does not cover capital cost even in FY28E. We do a sanity check of our EV/CE TP using the implied EV/EBITDA multiple. On our TP of INR 960, FY27E implied EV/EBITDA multiple is 12.9x, which is quite demanding, given its return profile. Risks to our SELL rating include stronger-than-expected sector tailwinds, investor apathy towards its valuation multiples and leverage.

Q2FY26 Results: Better than CIE expectations

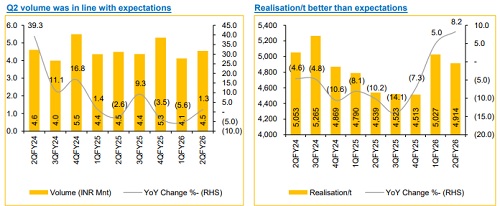

TRCL reported Q2FY26 revenue and EBITDA of INR 22,348 Mn (+9.6% YoY, +8.0% QoQ) and INR 3,869 Mn (+15.0% YoY, +9.1% QoQ) vs Choice Institutional Equities (CIE) estimate of INR 21,675 Mn and INR 3,099 Mn, respectively. Total volume for Q2 stood at 4.5 Mnt (vs CIE est. 4.4 Mnt), up 1.3% YoY and up 10.4% QoQ.

Blended Realisation/t came in at INR 4,914/t (+8.2% YoY and -2.3% QoQ), which was better than CIE’s est. of INR 4,876/t. Total cost/t came at INR 4,063/t (+5.7% YoY and flat QoQ). As a result, EBITDA/t came in at INR 851/t, up 156/t YoY and 115/t QoQ.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131