Sell Eicher Motors Ltd for the Target Rs. 5,846 by Motilal Oswal Financial Services Ltd

Focus on growth clearly visible

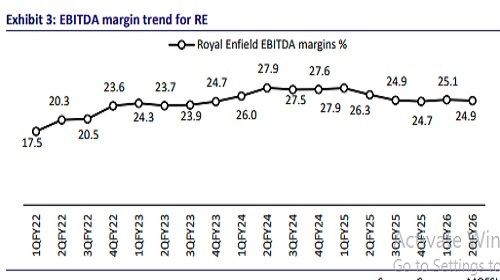

Margins fail to improve despite robust volume growth in RE

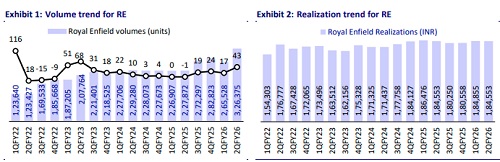

* Eicher's 2QFY26 consolidated PAT at INR13.6b was slightly lower than our estimates of INR14.4b, due to lower-than-expected margins in both segments. Despite the strong 43% YoY growth in volumes, margins declined 140bp YoY to 24.9% owing to Eicher’s focus on growth over profitability.

* The robust domestic volume growth for RE in FY26 so far has largely been a function of GST rate cut benefits. However, demand seems to have now normalized post an initial surge in pent-up demand. Further, given that management would continue to focus on “growth” over “profitability,” it would mean that margin upside is likely to be capped from here on. We factor in RE to post a 14%/14%/12% revenue/EBITDA/PAT CAGR over FY25- 28E. Given the expected slower earnings growth, we see no reason for the stock to trade at premium valuations. We reiterate our Sell rating with a TP of INR5,846. We value RE at 26x Sep-27E EPS and VECV at 11x EV EBITDA.

PAT below estimate due to lower margins in both businesses

* Eicher's consolidated revenue grew 45% YoY to INR61.7b (largely in line), aided by strong volume growth from the RE and VECV businesses. RE realizations were flat YoY at INR185k, while VECV realization grew 4.6% YoY in 2Q.

* On a standalone basis, revenue grew 40% YoY to INR59b – in line. Revenue growth was driven by a 43% YoY growth in volumes.

* However, despite the strong revenue growth, EBITDA margin dipped 140bp YoY to 24.9% (down 20bp QoQ) and 180bp lower than our estimates. This was largely on account of their focus on driving growth over profitability.

* EBITDA margin at VECV improved to 7.8%, expanding 70bp YoY, aided by a better product mix, lower discounts, and improving operating leverage.

* PAT share of VECV grew 20% YoY to INR1.4b – but was below our estimate of INR1.6b.

* Recurring PAT grew 24.5% to INR13.7b on the back of strong topline growth (below our estimate of INR14.4b).

Key highlights from the management commentary

* The company maintains its leadership in SAARC markets, ranked No. 2 in key regions such as the UK, Argentina, Thailand, and Korea, and is ranked No. 3 in Brazil and Australia, and No. 4 in the EU.

* After the GST rate hike in the >350cc segment, its 450cc is seeing much slower demand, while its 650cc is showing initial signs of picking up. Apart from the price hikes, the slowdown in these models is also a function of the strong pre-buy that these models saw before the GST rate hike.

* Other expenses were higher during 2Q due to higher marketing spending for brand building, community engagement, and market activations, which are expected to continue going forward.

* The GST rate cut is expected to support demand by increasing consumption and facilitating the movement of goods across regions. The company expects HCV demand to pick up in 2HFY26.

Valuation and view

The robust domestic volume growth for RE in FY26 so far has largely been a function of GST rate cut benefits. However, demand seems to have now normalized post an initial surge in pent-up demand. Further, we understand that RE had plans to launch multiple models on the 450cc Sherpa platform, which would now need to be recalibrated given that this segment has seen GST rates rise to 43%. Further, we expect exports to remain a growth driver and factor in a 21% volume CAGR in exports over FY25-28E. Further, given that management would continue to focus on “growth” over “profitability,” it would mean that margin upside is likely to be capped from here on. We factor in RE to post a 14%/14%/12% revenue/EBITDA/PAT CAGR over FY25- 28E. Given the expected slower earnings growth, we see no reason for the stock to trade at premium valuations. We reiterate our Sell rating with a TP of INR5,846. We value RE at 26x Sep-27E EPS and VECV at 11x EV EBITDA.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412