Reduce Divi`s Laboratories Ltd For Target Rs. 6,375 By Choice Institutional Equities

Revenue Momentum Hinges on Execution

DIVI is positioned for continued revenue growth, led primarily by the CS segment supported by a robust project pipeline. EBITDA margin is expected to expand moderately as Kakinada facility costs normalises and the product mix improves. Capex is now expected to exceed the previously set target of INR 20,000 Mn, driven by GLP-1 and other ongoing projects. In peptides, the focus remains exclusively on innovator contracts, with no plans to enter generics. While the company’s growth story remains intact, its trajectory is highly dependent on the ability to execute and scale up projects efficiently. We continue to value the stock at 45x the average of FY27–28E EPS, resulting in an unchanged TP of INR 6,375 and a maintained REDUCE rating. This also reflects comparatively slower growth versus certain peers actively scaling up in the CDMO segment.

Strong Beat with Robust Growth and Margin Expansion

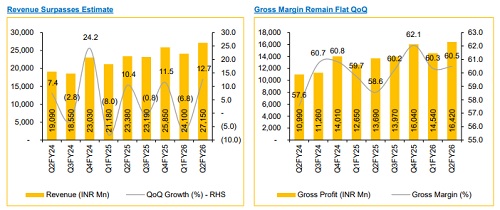

* Revenue grew 16.1% YoY / 12.7% QoQ to INR 27,150 Mn (vs. CIE estimate: INR 25,749 Mn).

* EBITDA grew 24.0% YoY / 21.8% QoQ to INR 8,880 Mn (vs. CIE estimate: INR 7,982 Mn); margin expanded 208 bps YoY / 246 bps QoQ to 32.7% (vs. CIE estimate: 31.0%).

* APAT increased 35.1% YoY / 26.4% QoQ to INR 6,890 Mn (vs. CIE estimate: INR 5,915 Mn).

Custom Synthesis (CS) Momentum Sustains; Scale-up Key to Growth

The company continues to see strong growth momentum in the synthesis segment, as three major projects are under execution, with an additional 3–4 projects in advanced validation. DIVI also maintains active collaborations with leading pharma players across Phase 1, 2, and 3 peptide programs, but no plan to enter the generic peptides space, focusing entirely on innovator contracts. We believe CS will be a key growth driver and expect this momentum to continue, though it remains contingent on the company’s ability to effectively scale up these projects.

Moderate Generics Growth amid Pricing Headwinds

The Generics segment continued to record moderate growth, weighed down by pricing pressures in key global markets, primarily the US and EU, which we do not expect to ease for at least the next two quarters. Consequently, we project high single-digit growth for generics. In contrast, the Nutraceuticals segment may see a gradual scale-up, supported b

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131