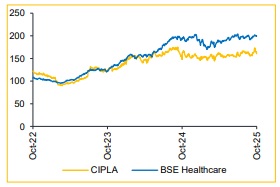

Reduce Cipla Ltd for the Target Rs. 1,580 by Choice Institutional Equities

Revenue Growth Intact; Margin under Near-term Pressure

We expect CIPLA’s revenue growth momentum to sustain, led by new launches in GLP-1s and biosimilars in India and the US. However, higher R&D spend and negligible Revlimid revenues are likely to pressure EBITDA margin from H2FY26. The management has revised FY26E EBITDA margin guidance to 22.8–24.0% (from 23.5–24.5%), although we expect margin support from the Eli Lilly partnership, starting H2FY27E

Reflecting this, we reduce our EPS estimate by 4.7%/4.2% for FY26E/FY27E. We retain valuation at 20x FY27–28E average EPS, leading to a revised TP of INR 1,580 (vs. INR 1,620 earlier) and downgrade to REDUCE, given limited near-term triggers and moderating margin trajectory.

Performance Holds Steady with Broadly In-Line Results

* Revenue grew 7.6% YoY / 9.1% QoQ to INR 75.9 Bn (vs. CIE estimate: INR 74.3 Bn).

* EBITDA grew 0.5% YoY / 6.6% QoQ to INR 18.9 Bn (vs. CIE estimate: INR 18.2 Bn); margin contracted 178 bps YoY / 59 bps QoQ to 25.0% (vs. CIE estimate: 24.5%).

* PAT increased 3.7% YoY / 4.1% QoQ to INR 13.5 Bn (vs. CIE estimate: INR 13.2 Bn).

FY26E Margin Seen at ~23%; Recovery Contingent on GLP-1 Ramp-up

H1FY26 performance remained strong with EBITDA margin at 25–25.5%. However, margin is expected to moderate sharply in H2FY26 due to: a planned increase in R&D expenditure (~7% of sales in FY26E vs. 5.5% in FY25); and a product mix shift as Revlimid revenues taper off (negligible by Q3FY26). In line with these dynamics, management has revised FY26E EBITDA margin guidance downward to 22.8–24.0% (from 23.5–24.5%). Importantly, this outlook does not incorporate potential upside from the recently-announced Eli Lilly partnership for the GLP-1 molecule, Yurpeak® (Tirzepatide). We forecast FY26E EBITDA margin at ~23.0%, with a moderate recovery to ~23.5% in FY27E, supported by revenue contribution from the GLP-1 franchise

India Momentum Holds; US faces Near-term Soft Patch

India and the US together accounted for ~68% of revenue in Q2FY26, underscoring their significance in the company’s portfolio mix. We expect India growth to be supported by new product launches, particularly in the GLP-1 and chronic therapy segments, alongside sustained leadership in existing respiratory brands, such as Foracort. In contrast, the US growth is likely to moderate to midsingle digits, as incremental revenue from Albuterol and new biosimilar launches (e.g., Filgrastim) only partially offset the tapering Revlimid contribution.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)