Oil and Gas Sector Update : US imposes additional 100% tariffs on China by Choice Institutional Equities

What has happened?

The President of the United States announced to impose an additional 100 % tariff on imports from China effective on, or even before, November 1, 2025. As a result, the Brent prices dipped by 4% to US$62.73 on Friday (Oct 10, 2025).

What could happen next?

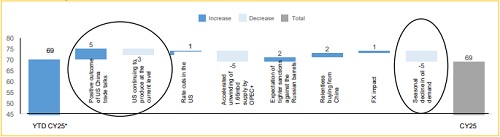

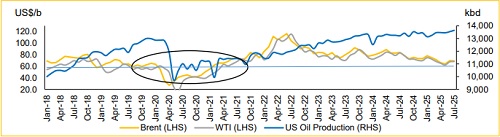

As highlighted in Exhibit 1, the positive outcome of US China trade talks would have supported average Brent prices for Calendar Year 2025 by the quantum of US$5/barrel(b). Although, there is possibility of trade negotiations till Nov 1, 2025, wherein a neutral to positive outcome could support Brent prices. However, in case of negative outcome, we see US oil production decreasing by 5%, accounting for about 1% of global oil supply, as the oil prices would sink below US$60/b. This would in turn provide balance to the oil markets.

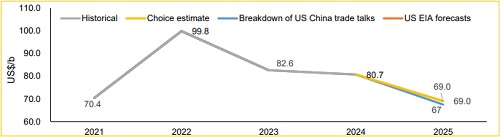

Overall, we maintain our estimate for Brent at US$69.0/b for the Calendar Year 2025 (as published on June 13, 2025) compared to YTD average of US$69.5/b. We have marked to market our estimates as a standard industry practice, exercised on quarterly basis. With the catalyst of US–China trade talks delayed longer than expected, and following a mark-to-market exercise, we have revised our Brent estimate under the ‘Breakdown of US–China Trade Talks’ scenario to US$67/b for Calendar Year 2025, compared with US$62/b published on June 13, 2025.

In the meantime, as per IMF, Saudi Arabia, de-facto leader of OPEC, requires a break-even oil price of about US$91/b to balance its fiscal accounts. However, in order to maintain the market share, Saudi Arabia and OPEC+ have been unwinding production. In our opinion, if the current oil prices persist, we see further increase in production by OPEC+ to be less likely in the near-term. The Indian imports from Russia does not seem to decrease although the talks with US are ongoing regarding the reduction in tariffs. The discount of Urals to Brent remains key parameter for India to continue buying Russian oil. In case the pressure further intensifies, we see the discount widening which along with lower oil prices may propel the GRMs higher.

Exhibit 1: Catalysts for Brent

Source: FactSet for Historical data, Choice Institutional Equities

*Note: YTD CY25 price as of Oct 13, 2025

Exhibit 2: Brent estimates

Source: FactSet for Historical data, Choice Institutional Equities, Note: US EIA estimate now align with the Choice estimate of US$69/b for CY25

Exhibit 3: US Production versus Oil prices

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

More News

Cement Sector Update: Weak prices offset leverage gains; all eyes on Jan hikes by Emkay Glob...