Neutral TATA Steel Ltd for the Target Rs. 180 by Motilal Oswal Financial Services Ltd

Capacity expansion on track; strong domestic business and improvement in Europe to drive earnings

Capacity expansion in progress

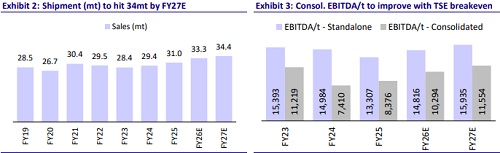

* Tata Steel (TATA) is pursuing an aggressive capacity expansion strategy in India to capitalize on the rising domestic demand. The company has outlined a target to double its crude steel capacity from the current 21.6MTPA to 40MTPA by FY30, with an annual capex commitment of ~INR100b.

* TATA commissioned India’s largest BF at Kalinganagar in FY25, increasing the capacity from 3MTPA to 8MTPA, backed by an investment of INR270b. The capacity ramp-up is currently on track and in phase-II of expansion. Management aims to increase the capacity by another 5MTPA, bringing the total to 13MTPA. Other initiatives include scaling Neelachal Ispat Nigam Ltd (NINL) from 1MTPA to 5.5MTPA, and commissioning a 0.75MTPA scrapbased electric arc furnace in Ludhiana by 2026. The company also plans to expand the Meramandali unit from 5 MTPA to 6.5 MTPA, aligning with broader capacity goals.

* TATA is actively restructuring its European operations for decarbonization and competitiveness. In the UK, it is converting its Port Talbot site to a 3 MTPA electric arc furnace (EAF), replacing traditional blast furnaces for significant cost savings and emission reduction. In the Netherlands (IJmuiden), TATA is evaluating a gas-based direct-reduced iron (DRI) and EAF route, but progression is contingent on Dutch government funding and regulatory clarity.

* TATA’s multi-pronged expansion plan is set to meet India's surging steel demand, maintain industry leadership, and align with global sustainability imperatives by FY30.

Favorable domestic business outlook

* India's steel demand is projected to grow ~8-10% over FY26-27, backed by a robust demand environment, policy support, and ongoing recovery in industry fundamentals.

* To protect against rising imports, the Indian government has imposed a 12% safeguard duty on flat steel products, helping to support domestic prices.

* TATA is well-positioned to benefit from India's strong domestic growth story through its capacity expansion and product diversification strategies. Currently, market sentiment for H2FY26 points to a gradual price recovery, muted costs (especially coking coal prices), and demand tailwinds.

Breakeven for European operations

* TATA Europe’s operations in the UK and the Netherlands have faced persistent financial challenges due to high energy/operational costs, unfavorable demand, and the obligation to reduce carbon emissions.

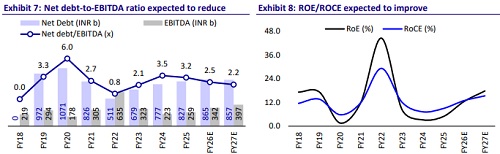

* Its operations are making visible progress toward breakeven, with recent quarters showing a narrowing of losses, particularly in the UK, and the capacity ramp-up underway in the Netherlands. The overall operating loss of USD76/t in 2QFY25 turned positive to USD8/t in 1QFY26, with further improvements expected due to cost optimization, lower energy prices, and the impact of the legacy BF shutdown in the UK.

* Management expects EBITDA losses from UK operations to further reduce in the coming quarters, supported by capacity ramp-up in the Netherlands and lower fixed costs, which should boost the overall EBITDA performance of its European operations.

Valuation and view: Reiterate Neutral

* TATA is one of the largest players in India's steel sector and is set to benefit from improving steel price realizations, operating efficiencies, and the strong domestic demand outlook. The implementation of the safeguard duty is expected to help domestic steel makers achieve better realization.

* While near-term challenges persist due to global uncertainty around tariff escalations, the long-term outlook for TATA remains strong. The Indian business is expected to continue its strong performance, and an improvement in the European business performance is likely to support overall earnings.

* At CMP, TATA is trading at 7.6x EV/EBITDA and 4.1x FY27E P/B. We believe that all the positives are well priced in. We reiterate our Neutral rating with an SOTP-based TP of INR180 per share on FY27 estimate.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412