Neutral Bajaj Auto Ltd for the Target Rs. 9,070 by Motilal Oswal Financial Services Ltd

Margins beat estimates, led by an improved mix

EV portfolio generates double digit margins for the first time

* Bajaj Auto’s (BJAUT) 2QFY26 earnings at INR24.8b were broadly in line with our estimate. While margins were 50bp ahead of expectations at 20.5%, led by an improved mix and favorable currency, lower other income limited earnings upside.

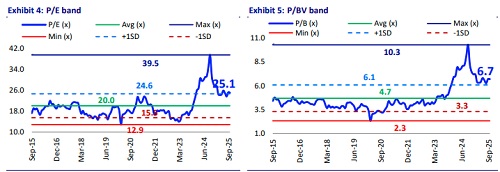

* While a recovery in exports and a healthy ramp-up of Chetak and 3Ws are key positives, market share losses in domestic motorcycles, particularly in its crucial 125cc+ segment, remains the key concern. While BJAUT has acquired a controlling stake in KTM under a lucrative deal, its effectiveness depends on how quickly it is able to turn around its operations, which will remain the key monitorable going forward. At ~25.7x/23.5x FY26E/27E EPS, BJAUT appears fairly valued. We reiterate our Neutral rating with a TP of INR9,070, based on 24x Sep27E core EPS.

Margin ahead of estimates on favorable currency and product mix

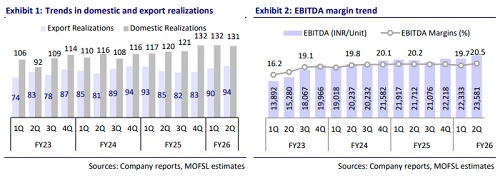

* Revenue in 2Q grew 14% to INR149b (in line), on account of volume growth of 6% and realization growth of 7%.

* The strong ASP increase was on account of a richer product mix and the highest-ever spare sales in 2QFY26.

* EBITDA margin expanded 30bp YoY to 20.5% (50bp ahead of our estimates) due to favorable currency and improved mix. ? EBITDA grew 15% YoY to INR30b (4% ahead of our estimates).

* Lower-than-anticipated other income limited PAT growth, which rose 12% YoY to INR24.8b vs est. of INR24.1b.

* CFO for 1H stood at INR48b and generated FCF of INR45b in 1H, while cash surplus at the end of Sep’25 stood at a healthy INR142b.

Highlights from the management commentary

* BJAUT’s focus areas include: 1) competitive growth in the 125 cc plus segment; 2) target to sustain export growth at 15-20%; 3) regain momentum in the EV segment by unlocking supply chain constraints; 4) focus on reviving KTM.

* Post GST rate cuts, management expects the motorcycle industry to post a 6- 8% growth in 2HFY26.

* The export momentum is likely to continue in the coming quarters, backed by strong demand from Latin American and Asian markets and stabilization in regions like Africa.

* EVs (2W + 3W) contributed 18% to domestic revenues, generating INR17b with double-digit EBITDA margins.

* BAL is currently producing at peak capacity in 3Ws, with further capacity being added to meet export demand.

* The company expects further commodity inflation in the coming quarters, though currency tailwinds should help offset the impact of the same.

Valuation and view

* While a recovery in exports and a healthy ramp-up of Chetak and 3Ws are key positives, market share losses in domestic motorcycles, particularly in its crucial 125cc+ segment, remains the key concern. While BJAUT has acquired a controlling stake in KTM under a lucrative deal, its effectiveness depends on how quickly it is able to turn around its operations, which will remain a key monitorable moving forward. At ~25.7x/23.5x FY26E/27E EPS, BJAUT appears fairly valued. We reiterate a Neutral rating with a TP of INR9,070, based on 24x Sep27E core EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412