Metals & Mining Sector Update : Q1FY26 Quarterly Results Review by Choice Institutional Equities

Coal India Ltd. (COAL): Good Q1FY26 But Structurally Unattractive Play

We have coverage on 1 company in the Metals & Mining sector i.e. Coal India Ltd. (COAL).

Q1FY26 Results

Sales volume at 190.6MT (-5.0% QoQ, -4.0% YoY) – were pre reported, within which e-auction volume was 21.3MT (-1.3% QoQ, -8.1% YoY). FSA realization came in at INR 1,550/t (+0.1% QoQ, +1.7% YoY). E-auction realization came in at INR 2,332/t (-10.8% QoQ, -3.3% YoY). Revenue (incl OOI) came in at Rs358.4Bn (-5.2% QoQ, -1.7% YoY) higher mainly due to higher than expected other operating income and better volume mix. EBITDA (ex- Stripping adj) came in at INR 111.2Bn (-0.9% QoQ, - 3.6% YoY) and PAT came in at INR 87.4Bn (-9.0% QoQ, -20.2% YoY).

Investment Thesis

We have a SELL rating on the company with a TP of INR 290/sh. Key pillars of our investment thesis are: 1) Attractiveness based on cheap valuation multiples is an optical illusion, 2) Discounted pricing and unfavorable sales mix, 3) Huge capex, yet EBIT momentum will be negative - running on a treadmill kind of a situation, 4) Cash is restricted due to large long term provisions, and 5) Declining GCV across subsidiaries.

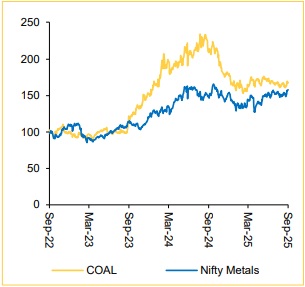

Rebased Price Chart

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131