Hold LTIMindtree Ltd For Target Rs. 5,470 By Prabhudas Lilladher Capital Ltd

Margin expansion strong in Q2, AI transition drag in top accounts

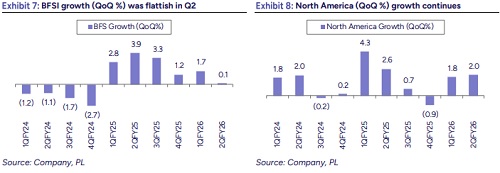

The revenue growth (+2.4% QoQ CC) was above our estimates (1.9% QoQ CC), aided by ramp up of large deal within Retail segment. Beyond selective pockets the growth was muted, especially BFSI and CMT verticals. Although the deal signing activities remain strong in these verticals, the scope of new work gets compromised against productivity benefits, which usually get passed on to marquee accounts. The management was claiming the impact is more transitional in nature and industry-oriented, which is expected to recoup against higher wallet share and deeper client relations in the subsequent quarters. With that its top 5 accounts de-grew 5.2% QoQ, which balanced against sharp uptick (+4.2% QoQ) in ex-top 20 accounts. Despite this fact, the management expects to have healthy H2 on the back of large deal ramp ups and anticipated pass-throughs. On margins, the internal program has exceptionally pulled the margins in Q2 by 80 bps QoQ, while the rest 80bps achieved through INR depreciation. Given H2 will have disproportionate passthroughs and wage hike impact, we are partially passing on the margins benefits to FY26. We are baking CC revenue growth of 5.1%/8.4%/8.5% YoY in FY26E/FY27E/FY28E, while keeping our margins at 14.9%/15.4%/15.7%. With that our EPS sees an upgrade of ~2% each in FY27E/FY28E. We roll forward and assign 25x PE to Sep’27E EPS for a TP of 5.470, full valuations. Retain HOLD

Revenue: LTIM delivered a strong revenue performance, beating expectations with USD 1.18 billion in revenue, up 2.4% QoQ in CC versus our estimate of 1.9%. Growth was broad-based across geographies and verticals, led by large deal rampups in Consumer and Healthcare, which reported robust QoQ growth of 9.1% and 10.2%, respectively.

Margin: EBIT margin performance was strong, supported by operational efficiencies and currency gains. LTIM reported an operating margin of 15.9%, expanding 160 bps QoQ, driven equally by +80 bps from its “Fit-for-Future” margin improvement program and +80 bps from forex tailwinds and the non-recurrence of visa costs. LTIM reported net profit of Rs. 14 bn, up 10.1% QoQ aided by beat in margins.

Deal Wins: Deal wins remained steady with order inflow of USD 1.59 bn compared to last 4 quarters including Q2 order book average of USD 1.63 bn. LTIM won a large deal in all 5 of its segments. Deal pipeline for the company remains robust with combination of vendor consolidation and cost optimization deals.

Valuations and outlook: We are factoring in a USD revenue and earnings CAGR of 7.6% and 14.4%, respectively. The stock is currently trading at 28x its FY27E earnings, and we assign a target PE of 25x LTM Sep. 27E earnings to arrive at a target price of INR 5,470. We maintain our “HOLD” rating.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)