Healthcare Sector Update : Absence of seasonal momentum to impact Q2 performance by Emkay Global Financial Services Ltd

We expect Q2FY26 to be relatively soft for our covered hospital and diagnostic companies, due to a lower incidence of vector-borne diseases despite strong rains. Buoyed by bed additions, we model continued volume momentum (OBD up 16% YoY), with an improving case and payor mix leading to steady ARPOB gains; this would drive revenue/EBITDA by 22%/9% YoY in Q2 for our covered hospital stocks. Max is likely to lead the pack (revenue/EBITDA growth of 27%/19% YoY) due to ramping up of recently commissioned facilities and bed additions in Mumbai, Delhi, and Mohali. For KIMS, we expect a drag from the newly launched units in Thane, Bengaluru, and Nashik (~Rs450mn) to weigh on overall EBITDA margins (19.8%; down 230bps QoQ); meanwhile, Rainbow’s growth momentum should moderate (+12% YoY) due to muted volume growth (OBD up 5% YoY). Similarly, for diagnostics companies, a lower incidence of monsoon-related illnesses and an unfavorable base are likely to impact revenue growth. We expect Vijaya/Metropolis (organic)/DLPL to report topline growth of 12%/12%/10%, respectively, mainly driven by test volume growth.

Hospitals: Focus on ramping up of new units

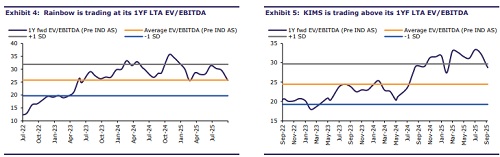

Given bed additions planned in FY26, we believe investors are likely to focus on rampups of newly launched facilities to gauge demand, competitive intensity, and determine earnings trajectory over 2-3Y. Additionally, commentary on CGHS revision aiding fasterthan-expected breakeven for new units is a key monitorable. We expect our covered companies to log revenue growth of 22% YoY, mainly on volumes (OBD rising 16% YoY). Among our covered names, Max should see the strongest revenue growth (+27% YoY), as we expect continued bed additions and sustained ramp-ups of newly commissioned hospitals. We expect a muted quarter for Rainbow due to a drop in the incidence of vector-borne diseases and project execution delays continuing in Bengaluru. For KIMS, we expect healthy topline growth (25% YoY), though a higher-than-expected drag from new facilities (~Rs450mn) would impact profitability (EBITDA growth of 9% YoY, margins down 230bps/830bps QoQ/YoY). For Medanta, we expect a steady quarter, with the developing portfolio (up 24% YoY) continuing to outpace the matured one (up 9% YoY).

Diagnostics: Soft quarter in the absence of monsoon-related illnesses

Due to a lower incidence of monsoon-related illnesses (dengue, malaria, etc) and an unfavorable base, we expect a soft Q2 for diagnostics players. For Metropolis, we expect 23% YoY revenue growth in Q2FY26 (12% organic), with better margins (+225bps QoQ), as acquisitions ramp up. DLPL is expected to post another steady quarter, with 10% YoY revenue growth, driven by sample growth (+10% YoY). Due to an unfavorable base and the festive season starting in Q2 in core markets of Vijaya, we expect only 12% YoY revenue growth, with stable EBITDA margin despite accelerated hub additions in H1FY26.

CGHS revision – A sweeping positive move

The recent CGHS rate hikes are expected to accelerate breakeven timelines for new hospital units, in our view, given the higher contribution of scheme patients. Among our covered names, KIMS, Max, and Medanta stand to gain from this, given that their exposure to scheme business (CGHS + other state government schemes) is ~18-22% (Exhibit 19). Assuming a 15% weighted average hike in scheme rates, hospital ARPOBs could rise 2.5-3.5%, translating to an estimated 11-13% increase in EBITDA.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

More News

Oil and Gas Sector Update : CGD ? UFT rezoning announced amid volatile gas costs by Emkay Gl...