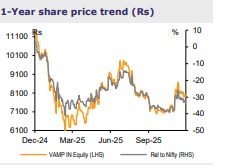

Buy Voltamp Transformers Ltd for the Target Rs.10,000 by Emkay Global Financial Services Ltd

We maintain BUY on Voltamp Transformers (VAMP) while cutting our TP by ~12% to Rs10,000 (from Rs11,350 earlier), valuing the stock at 25x FY28E EPS. VAMP’s strong market position (15% share in the industrial segment) stems from its design and manufacturing depth, along with a broad product portfolio that serves a diversified customer base – with private clients contributing ~85% of revenue. With its established track record, we believe the company is strategically placed to benefit from a multi-year growth cycle supported by private capex revival and the GoI’s PLI-driven manufacturing push. The current opportunities across solar energy, railway capex, EV charging infrastructure, green hydrogen, and data centers further widen VAMP’s addressable market. While we expect a high double-digit revenue growth led by capacity expansion and a lean balance sheet, we trim our margin estimates due to rising industry supply from planned capacity additions by several players.

Order inflow growth healthy VAMP continues to log healthy order inflow, at 37%/12%/37% YoY for FY24/25/1HFY26, respectively – benefitting from its well-diversified client base. Key noticeable endmarkets that led to strong growth are Metal and Mining, Infrastructure, Commercial Real Estate, Transcos (GETCO and Other Private), and renewable. Going ahead, the management pointed to a strong enquiry pipeline ahead led by healthy industrial demand as well as demand from power utilities for grid expansion and strengthening. Current order book stands at ~Rs14bn (0.7x TTM revenue).

Capacity addition on track Given the strong demand and order inflow, VAMP has been operating at its total current capacity of 14,000MVA. It is investing Rs2bn (funded via internal accruals) for adding 6,000MVA capacity in Vadodara (for an up to 220kV range), which will lift its total installed capacity to 20,000MVA. The plant is scheduled to come onstream by Q1FY27E and will ramp up capacity utilization to 50-60% by FY27E, pick up pace thereafter.

Increasing industry supply to result in gradual margin normalization Over the past few years, VAMP has benefited from a cyclical upturn, with EBITDA margin rising from 12.3% in FY22 to 18.9% in FY25. The sharp improvement was driven by higher demand vs supply, elevated lead times, and supply-chain disruptions in CRGO and other critical components, all of which supported pricing premiums. With several players (including VAMP) expanding capacity and seeing their supply chain normalizing, we expect profitability too to gradually achieve normalization.

Valuation and our view We tweak our estimates and factor in strong order inflow growth in 1H along with lower margin estimates. We maintain BUY on the stock with a revised down target price of Rs10,000 @25x FY28E EPS.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354