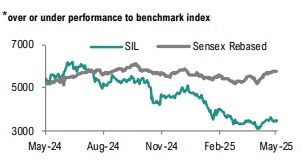

Buy Supreme Industries Ltd For Target Rs. 4,107 By Geojit Financial Services Ltd

Muted Q4 volumes; recovery ahead

Supreme Industries Ltd. (SIL) is India’s leading player in plastic products; the company’s wide range of offerings include plastic piping systems, packaging, industrial and consumer products.

• Revenue was flat YoY, primarily due muted volume growth of 2.3% YoY and a 3% YoY decline in realisations due to the volatility in PVC resin prices.

• The combination of reduced government infrastructure spending, a slowdown in the real estate sector, and persistent price fluctuations in PVC led to destocking, adversely impacting overall volumes and profitability.

• EBITDA margins contracted by 256 bps YoY to 13.8%, largely attributable to an increase in other operating expenses. As a result, the net profit declined by 17% YoY.

• We believe PVC prices have largely stabilized, with affordability improving significantly. A recovery is anticipated in FY26, supported by a healthy in demand from the agriculture sector, as well as a rebound in real estate and construction activities.

• We project a 12% CAGR in volume and 10% in revenue from FY25-27E. Profitability is expected to grow at a CAGR of 23% supported by better realisations.

Outlook & Valuation

We anticipate FY26 to reflect improved performance, underpinned by a improved demand from plastic piping segment supported by increased government spending and sustained momentum from the real estate & construction sectors. SIL's longterm prospects remains robust, diversified product portfolio, consistent market share gains evidenced by its superior growth relative to its peers, healthy operating margins, and a robust balance sheet. We value SIL at a P/E of 36x (5-yr avg.) based on FY27E EPS, with a target price of Rs.4,107. We reiterate “BUY” rating on the stock.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345