Buy Cello World Ltd for the Target Rs.600 by Motilal Oswal Financial Services Ltd

Consumerware mars overall performance Earnings miss our estimate

* Cello World (CELLO) reported a muted quarter with flat revenue growth due to flat growth in the consumerware segment. Following the implementation of BIS norms, the company has been unable to import products of BIScompliant quality, resulting in a 40% dip in steelware revenue. Further, the molded furniture segment declined 11% YoY due to weakness in polymer prices, which was partially offset by a 10% growth in the writing instrument segment, led by healthy growth in both export and domestic markets.

* The company expects an 8–10% revenue growth until 1HFY27, with pickup expected after that due to increasing utilization in the glassware plant, stabilization in the steelware business, and growth in the Writing Instruments segment (through Cello and Unomax).

* Factoring in lower-than-estimated earnings in 3Q and management guidance, we cut our FY26E/FY27E/FY28E earnings by 12%/15%/11%. We reiterate our BUY rating with a TP of INR600 (premised on 27x FY28E EPS).

Weakness in margins due to operating deleverage

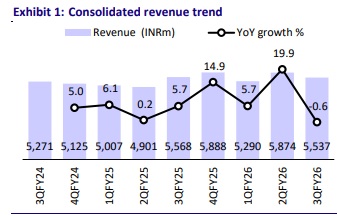

* In 3QFY26, CELLO's consol. revenue remained largely flat YoY, while it declined 5% QoQ to INR5.5b (est. INR6.1b). EBITDA declined ~17%/17% YoY/QoQ to INR1.1b (est. INR1.4b).

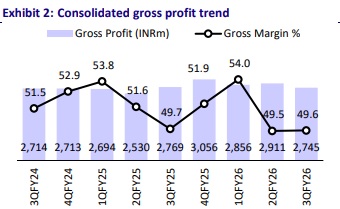

* EBITDA margin contracted 380bp/260bp YoY/QoQ to 19.1%, largely due to higher employee costs/other expenses (up 200bp/170bp YoY and 60bp/200bp QoQ). Gross margin contracted 10bp YoY to 49.6%, while it remained flat QoQ.

* Adj. PAT declined ~20%/19% YoY/QoQ to INR692m (est. INR903m). The company had a labor code impact of INR74m.

* Consumerware segment’s revenue (70% of total revenue in 3QFY26) remained flat YoY, while it declined 9% QoQ to INR3.9b. Gross margin expanded 20bp YoY.

* Writing instrument segment’s revenue (~15% revenue mix) grew 10%/4% YoY/QoQ to INR853m. Further, molded furniture and allied products (~12% of the revenue mix) declined 11%/1% YoY/QoQ to INR830m. The gross margin of writing instruments expanded 210bp YoY, while that of molded furniture and allied products declined 450bp YoY.

Highlights from the management commentary

* Steelware: Stockouts in insulated steel products led to a 40% drop in steel revenue; without these constraints, the consumerware segment could have grown ~12% YoY. Although the company had built 6–8 months of inventory post-BIS implementation and sourced from local OEMs, it currently faces product shortages and plans to ramp up production to restore growth.

* Writing Instruments: The company expects the Cello brand to start contributing from 4QFY26 and targets combined revenue of INR5b from Cello and Unomax in FY27, with plans to scale this to over INR10b in the following years. Given that stationery forms a relatively small portion of BIC Cello’s portfolio, management sees significant growth potential in this segment.

* Glassware: The glassware facility is currently operating at ~60% utilization and is expected to remain at similar levels over the next couple of quarters. The company aims to ramp up utilization to ~80% by the end of FY27. At present, the facility is operating at break-even and is not yet profitable.

Valuation and view

* The company expects sustained healthy growth in the writing instruments segment, supported by the addition of the Cello brand to its portfolio. Meanwhile, the consumerware segment is expected to stabilize from 2HFY27 onward, driven by normalization in steelware and improved capacity utilization in the glassware segment.

* We expect CELLO to register an 11%/13%/13% revenue/EBITDA/Adj. PAT CAGR over FY25-28. We reiterate our BUY rating with a TP of INR600 (premised on 27x FY28E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412