Buy Nuvoco Vistas Corporation Ltd for the Target Rs. 560 by Choice Institutional Equities

Sectoral Tailwinds to Complement Company Fundamentals

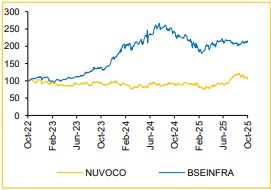

We maintain our BUY rating on NUVOCO with a target price of INR 560/sh. We continue to be constructive on NUVOCO owing to 1) Sectoral tailwinds - positive outlook for demand growth and pricing, 2) Company-specific positives, such as a) strong capacity addition of 10 Mtpa by FY27E, b) premiumisation initiatives, c) better geographical optimisation and d) ongoing cost-saving program which targets INR 50/t saving in FY26E. We like NUVOCO’s capital structure with debt levels above 2.0x of EBITDA. There is an optionality to expand footprint in newer markets, such as UP, MP and Maharashtra. On the basis of our realistic assumptions, NUVOCO’s ROCE expands by 1,200bps from 3.9% in FY25 to 15.9% in FY28E. NUVOCO continues to be amongst our high conviction picks in the cement sector.

We forecast NUVOCO’s EBITDA to expand at a CAGR of 31.4% over FY25 – 28E based on our volume growth assumptions of 6.0%/8.0%/10.0% and realisation growth of 6.0%/1.0%/1.0% in FY26E/27E/28E, respectively.

We arrive at a 1-year forward TP of INR 560/share for NUVOCO. We value NUVOCO on our EV/CE framework – we assign an EV/CE multiple of 1.6x/1.6x for FY27E/28E. We did a sanity check of our EV/CE TP using the implied EV/EBITDA multiple. On our TP of INR 560, FY28E implied EV/EBITDA multiple is 6.0x, which makes NUVOCO amongst the cheapest mid to large-sized cement companies in our coverage.

Risk to the thesis:

Risks related to feedstock availability and prices, including potential impact from geopolitical situation on pet coke cost and rake availability.

Regulatory and demand-side risk potential hikes in state levies on limestone and a slowdown in government spending on infrastructure pose risk to cost structure and demand visibility.

Q2FY26 Results: Strong YoY EBITDA Surge Supported by Better Realisation

NUVOCO reported Q2FY26 consolidated Revenue and EBITDA of INR 24,576 Mn (+8.3% YoY, -14.5% QoQ) and INR 3,670 Mn (+67.8% YoY, -29.2% QoQ) vs Choice Institutional Equities (CIE) estimate of INR 24,112 Mn and INR 3,488 Mn, respectively. In our view, market expectation of Q2FY26 EBITDA was in the range of INR 3,470 – 3,800 Mn. Total volume for Q2 stood at 4.3 Mnt (vs CIE est. 4.4 Mnt), up 2.4% YoY and down 15.7% QoQ.

Realisation/t came in at INR 5,715/t (+5.8% YoY and +1.5% QoQ), which is better than CIE est. of INR 5,520/t. Total cost/t came in at INR 4,862/t (-0.4% YoY and +5.3% QoQ). As a result, EBITDA/t came in at INR 853/t, which is a decline of ~INR 163/t QoQ.

EBITDA/t Expected to Reach INR 1,069/t in FY26E with the Support of the Project SPRINT & Project BRIDGE

NUVOCO is targeting ~INR 50/t cost saving in H2FY26E through multiple initiatives: 1) Ramping up of slag usage, from 45,000 to 75,000t/month, 2) Upgrading Nimbol WHRS from 4.7 MW to 6.6 MW (with ~INR 100 Mn capex), 3) Increasing AFR usage from 12% to 15–16%, 4) Setting up hybrid wind solar power in the North, 5) Reducing lead distance by 12–15 km and 6) Commissioning the Odisha railway siding for 100% clinker movement to Jaipur by Q3. We expect these initiatives will lead NUVOCO to increase its EBITDA/t above INR 1,000/t in FY26E.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131